Investing in stocks can feel like a daunting venture for many, especially when it comes to choosing the right stock. How do you determine whether a stock is a good investment? A key strategy involves using financial ratios as selection criteria, and one of the most significant of these ratios is the Earnings Per Share (EPS).

Demystifying Earnings Per Share (EPS)

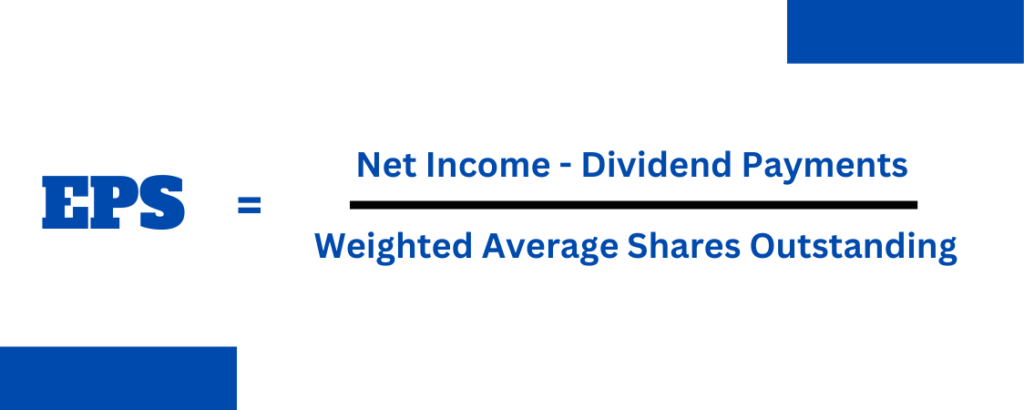

The EPS is a measure of a company’s success on a per-share basis and is a metric that investors commonly use to evaluate a company. Essentially, you calculate this by subtracting any preferred dividends from a company’s net income and then dividing the result by the number of outstanding shares.

Why subtract preferred dividends? Preferred stockholders have contractual entitlements to dividend payments. Therefore, it’s important to deduct these dividends to see the net income available for common shareholders.

Companies announce their EPS in their annual (10-K) and quarterly (10-Q) SEC filings, usually within the Consolidated Statements of Operations (or income statements). When it comes to earnings, a company can either distribute the cash to shareholders or reinvest it back into the business. Being able to calculate EPS independently can be beneficial for various reasons.

Calculating EPS: A Closer Look

In its simplest form, you can calculate EPS by dividing the net income (earnings) by the number of shares outstanding. However, a more detailed calculation would adjust the numerator (top part of the equation) and denominator to account for shares that could be created through options, convertible debt, or warrants.

The balance sheet and income statement provide the information needed to calculate EPS, including the number of common shares at the end of the period, dividends paid on preferred stock, and net income or earnings. The number of common shares can change over time, so using a weighted average for the reporting period is more accurate.

It’s also crucial to consider stock dividends and splits when calculating the weighted average number of shares outstanding. Some data sources simplify the calculation by using the total number of shares outstanding at the end of a period.

Making Sense of EPS

EPS is a vital tool in assessing a company’s success. It significantly influences the price-to-earnings (P/E) ratio, where the EPS is the “E”. By dividing a company’s share price by its EPS, an investor can ascertain the value of a stock in terms of how much the market is prepared to pay for each dollar of earnings.

EPS is one of several key metrics to consider when selecting stocks. If you’re interested in stock trading or investing, the next step would be to choose a broker that aligns with your investment style.

While comparing EPS in absolute terms may not be particularly insightful (since common shareholders don’t directly access the earnings), it’s more useful to compare the EPS with the stock’s share price. This helps investors assess the value of earnings and their confidence in future growth.

Basic EPS vs. Diluted EPS

Basic EPS does not account for potential dilution arising from new stock issuance by the company. If stock options, warrants, or restricted stock units (RSU) are part of a company’s capital structure and they are exercised, this could increase the number of outstanding shares on the market.

To provide a more transparent view of the impact of new securities on per-share earnings, companies also report diluted EPS. This figure assumes that all shares that could be outstanding have been issued.

For example, NVIDIA might have generated and issued a total of 23 million shares from its convertible instruments for the financial year ending in 2017. Adding this to the existing shares results in a diluted weighted average of 564 million shares. Dividing $1.67 billion (the net income) by .564 million gives the company’s diluted EPS of $2.96.

Interpreting a Negative EPS

Not all businesses make positive revenue. When a company records losses, its EPS becomes negative. This can also be referred to as a “net loss per share”. It’s essential to remember, however, not to take a low or negative EPS at face value.

Biotech companies, for example, often endure years of financial loss before creating a sellable treatment. Similarly, startups may need time to boost sales and revenue. If such a company is steadily reducing its losses and moving towards a positive EPS, it’s a good sign.

Like startups, established companies may encounter significant one-time costs, such as write-offs for major investments. These costs can lead to a temporary drop in income and EPS, but this doesn’t necessarily mean a bleak long-term outlook. A negative EPS is not cause for alarm if it’s an anomaly rather than a recurring trend.

Conclusion | Earnings Per Share (EPS)

EPS is a fundamental indicator of successfulness and is crucial when comparing the price of a stock to a company’s real earnings. Generally, higher earnings per share are desirable, but it’s crucial to consider the number of shares outstanding, the potential for share dilution, and long-term successful trends. A company’s stock price can rise or fall based on whether its EPS meets or falls short of analyst forecasts. As an investor, understanding how to interpret and use EPS is a key tool in your investing toolbox.