Commodities play an important role in the global economy as raw materials that underpin industries and are used to produce a variety of goods. For investors, commodity assets can also offer valuable diversification in an investment portfolio. However, directly investing in physical commodities like oil, gold or corn involves challenges around storage and transport. This is where commodity exchange-traded funds, or commodity ETFs, provide a solution.

This article explores what commodity ETFs are, how they work, the types available, and the pros and cons of using these funds as part of an investment strategy.

What Are Commodity ETFs?

Commodity ETFs are funds traded on stock exchanges that aim to track the performance of commodity prices. They do this through a fund portfolio of commodity futures contracts rather than by holding the physical commodities themselves. This provides investors with a cost-effective way to gain exposure to commodities without the hassle and costs associated with owning physical assets.

They provide investors exposure to a single commodity like oil, gold, or corn through a commodity index investment. They can also provide access to diversified portfolios tracking broad commodity indices made up of energy, metals, agriculture, and livestock products.

The value of a commodity ETF is directly tied to the underlying commodity’s future prices. As futures rise and fall, so too does the fund value. Holders benefit from commodity price appreciation and risk losses if prices decline over the investment period.

How Do Commodity ETFs Work?

Commodity ETFs generate their returns by selling and buying futures contracts in the commodities comprising their tracking index. This allows the funds to closely follow the underlying commodity spot prices without physically holding the assets.

When an ETF purchases futures contracts, it agrees to buy the commodity at a set price on a predetermined delivery date in the future. As the futures delivery date nears, the ETF will sell the expiring contract and purchase a new dated contract to maintain exposure over time.

This process, known as ‘rolling’, ensures the ETF portfolio and net asset value remain correlated with spot commodity market moves. Any gains or losses from rolling contracts are captured at the ETF portfolio level and reflected in its daily share price.

The ETF holds sufficient cash reserves from futures premiums paid to collateralize its positions without taking physical delivery. It continuously recycles these funds into new futures contracts as older ones expire and terminate, maintaining long exposure.

This futures-based structure means commodity ETFs are passively managed and aim for consistent tracking error relative to an underlying commodities index. Trading futures provides a cost-effective alternative to holding physical raw materials.

Types of Commodity ETFs

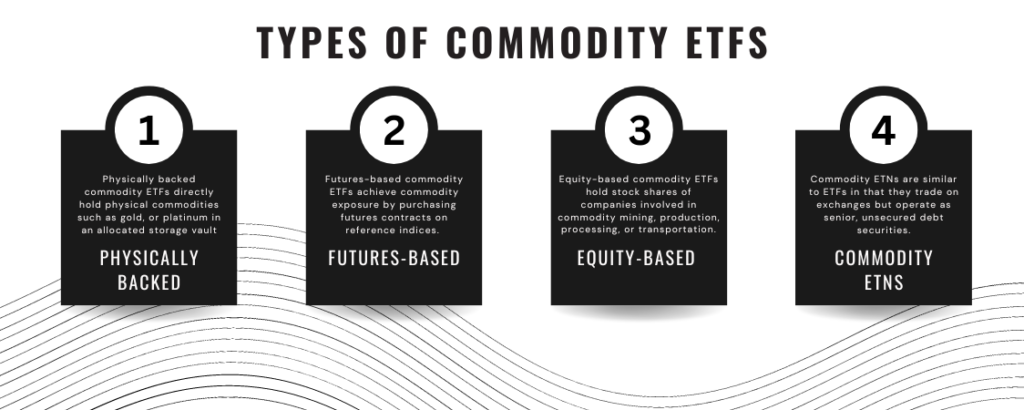

Commodity ETFs can be classified into different types according to the way in which they offer investors exposure to the benchmark asset.

Physically Backed

Physically backed commodity ETFs directly hold physical commodities such as gold, silver, or platinum in an allocated storage vault. This structure avoids the futures “roll costs” experienced by futures-based ETFs. However, physically backed ETFs take on additional expenses related to storage, insurance, and transportation of the physical commodities. Examples include ETFs that hold gold, like the Sprott Physical Gold Trust.

Futures-Based

Futures-based commodity ETFs are the most prevalent structure currently. They achieve commodity exposure by purchasing futures contracts on reference indices. This keeps costs lower than physical storage models. However, futures-based ETFs are still susceptible to roll costs when futures contracts near expiration. Most major commodity index tracking ETFs fall into this category, like the Invesco DB Commodity Index Tracking Fund.

Equity-Based

Rather than commodity exposure directly, equity-based commodity ETFs hold stock shares of companies involved in commodity mining, production, processing, or transportation. This provides related equity market exposure rather than direct access to commodity prices. ETFs such as the VanEck Vectors Gold Miners ETF use this approach.

Commodity ETNs

Commodity ETNs are similar to ETFs in that they trade on exchanges but operate as senior, unsecured debt securities. They rely on the credit of the issuing institution and track futures indices. Total returns reflect index performance net of fees. Examples include ETNs from banks like Barclays that track copper or natural gas subindexes.

Pros and Cons of Commodity ETFs

ETFs that track commodities can be useful instruments for portfolio diversification, but they also carry several serious risks, like short-term price volatility. Before investing in these ETFs, investors would be well advised to educate themselves about the pros and cons of these products.

Pros

- Diversification: Broad basket ETFs mitigate individual commodity risk versus single-asset concentration.

- Transparency: Holdings, returns, and net asset values are published daily for efficient valuation and tracking.

- Convenience: Eliminate hassles of taking physical delivery, transporting, storing, and insuring commodities.

- Inflation hedge: Commodity prices typically rise along with increases in the cost of products and services.

Cons

- Tracking Error: Difficult to consistently replicate index performance caused by factors like roll yield.

- Futures Contract Roll: Exposure shifts based on commodity term structure shape during roll periods.

- Correlation Risk: Returns may not hedge equities well during periods of high market volatility.

- Taxation: Generates capital gains/losses annually versus long-term buy-and-hold investments.

Conclusion

Commodity ETFs are a low-cost, efficient vehicle for gaining diversified exposure to raw material assets without the complexity or expenses of physical ownership. Fundamentally driven commodity returns exhibit a low correlation with other investment classes, and commodity ETFs can provide useful diversification and an inflation hedge for balanced portfolios. With transparency, liquidity, and risk management, commodity ETFs enable even small investors to access commodities markets. Understanding the details of ETF structures and strategies is important for proper use within individual goals and risk tolerances.