When is the Forex Market Considered Volatile?

The foreign exchange (forex) market is comprised of trades made globally, 24 hours a day, involving most of the world’s widely traded currencies. With its massive trading volume far exceeding other financial markets, even small geopolitical or economic developments can trigger significant forex price shifts. While always fluctuating to some degree, there are certain periods when exchange rates experience heightened instability or unpredictability – in other words, when the forex market becomes more volatile.

One factor that influences volatility is overall trading volume and liquidity. On days with less activity due to holidays or weekends, minor news can cause disproportionate swings until markets adjust. In contrast, high-volume hours absorb shocks with less disruption. Major economic releases from powerful nations like the US also spike volatility temporarily as new information impacts currency valuations extensively traded. Therefore, periods surrounding low-liquidity events or significant announcements tend toward elevated market instability when even routine news provokes expanded reactions.

What Market Forces Drive Increased Volatility?

No outside market exists in isolation, so global financial conditions influence the forex market’s volatility. Stock index downturns historically coincide with elevated currency market instability. During periods of generalized risk aversion like recessions, losing bets trigger steeper liquidations across the forex when pessimism reigns. Major financial crises demonstrate effects magnified, with “flight to quality” trades whipsawing safe-haven and risk currency pairs violently. Correspondingly, stable worldwide growth periods see more subdued cross-border currency price fluctuations.

Geopolitical tensions also act as volatility drivers. War threats, regional conflicts, and shifts in trade policies introduce uncertainties intensifying forex gyrations. Even rumors spark impulsive reactions until dismissed, especially involving nuclear nations or economically strategic regions. Around elections or leadership successions, transition outcomes stoke speculation movements. However, established democracies see smoother currency impacts than question marks over new administrations or unstable allies. Overall, a lack of predictability in how global news may play out tends to roil currency markets heightening short-term instability.

How Can Traders Manage Volatility Risk?

Given unstable periods’ inevitability, forex participants manage inevitable risks through careful preparation. Diversification across varied currency pairs mitigates overreliance on any individual market’s direction. Tight stop-losses contain potential downside from sudden swings against open positions. Traders also scale into trades gradually rather than jumping in fully exposed. Leverage usage warrants moderation during elevated volatility patches to avoid excess margin calls amplifying volatility’s financial impact too. Overall, discipline, prudence, and thoughtfully constructed strategies help navigate turbulent markets instead of reacting impulsively to short-term gyrations.

What Forex Pairs Demonstrate Higher Volatility?

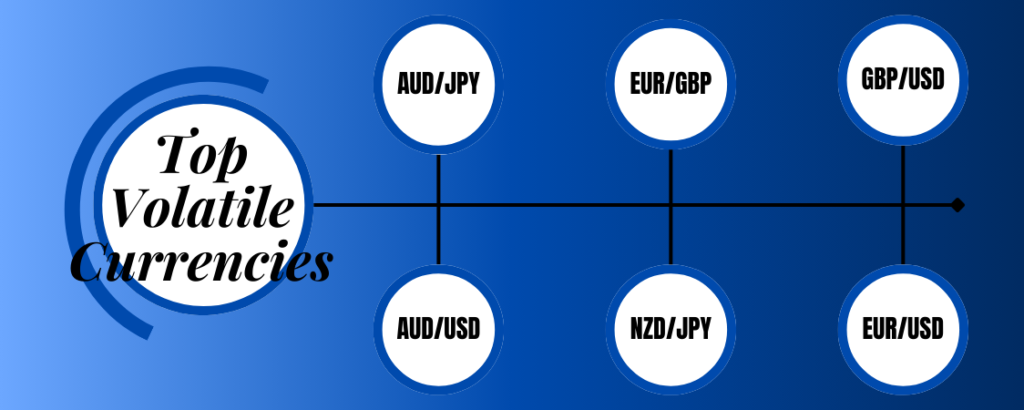

Examining historical data on currency pair volatility sheds light on which combinations see stronger fluctuations often. Generally, pairs involving emerging markets currencies or commodity-linked ones fluctuate more than stable developed nation cross-rates. For instance, Mexico’s peso or Turkey’s lira-dragging linked pairs experience bouts of high instability. Pairs like AUD/JPY and NZD/JPY also show erratic swings tracking risk trends and commodity price drivers. Currencies of smaller or politically evolving nations tolerate wild short-term swings too until consolidating.

However, even heavily traded G10 currency crosses like EUR/USD or GBP/USD experienced notable volatility boosts surrounding liquidity drains and high-impact events. Ultimately, market depth and a trading partner’s economic resilience tend to dampen volatility for pairs with stable constituents.

How Do Geopolitical Events Impact Currency Volatility?

Significant geopolitical developments rank among the most meaningful short-term currency volatility catalysts. For example, conflicts involving major powers spark immediate uncertainty and risk-off reactions globally. Even rumors of tensions flare volatility. Wars, terror attacks on coalition members, and threats to cut off natural resource shipments tend to undermine risk currencies while supporting safe havens like the yen and franc.

Significant shifts in long-standing political alliances or withdrawals from major trade deals also roil currency markets until consequence analyses solidify. Election upsets and unstable governments introducing economic strategy question marks likewise fuel short-term gyrations across many currency pairs. However, impacts moderate for predictable peaceful transitions in established democracies where continuity remains probable. Overall, international political stability fosters calmer currency climates versus episodes introducing binary unknown outcomes stimulating forex volatility spikes.

What Economic Reports Drive Forex Market Instability?

Looking at recurring macroeconomic events capable of heightening currency volatility, some stand out for market-moving potential. Key dates delivering unexpected inflation, growth, employment, or other statistically significant surprises from major economies prompt rapid repricing. For example, non-farm payroll figures from the United States rank among the highest single-day volatility culprits. Similarly, China’s monthly activity stats and Europe’s preliminary GDP readings shake up markets.

Other inflation and factory productivity metrics penetrate volatility when straying from estimates. Interest rate decisions along with any unscheduled central bank policy shifts also influence volatility horizons. Therefore, awareness of upcoming high-impact releases mitigates risks of being caught wrong-footed by data surprises sparking volatility spikes.

How Can Traders Capitalize on Volatile Markets?

While elevated volatility introduces risk, appropriate strategies position forex participants to benefit. Short-term traders scalp quick pips entering and exiting moves promptly under tight stops. News events offer volatility premiums compensating for added risk if directionality favors. Options provide leveraged upside plays hedging downside exposure from uncertainty.

Traders can also probe Intermarket relationships, shorting stable currencies and funding volatile carry trades when risk flares. Fundamental analysts seeking long-term value also track volatility mean reversions, picking oversold currencies after turbulence passes. Overall, prudence remains paramount but volatility brings an opportunity for nimble operators to leverage informative price action rather than reacting emotionally to short-lived gyrations. Steady hands prepared and patience to act selectively amid disorder profit consistently.

Conclusion | When Is The Forex Market Volatile?

As the largest most liquid market globally, even subtle influences resonate strongly through currencies at times, causing the forex market to be volatile. However, awareness of recurrent catalysts like data surprises, geopolitical developments, positioning extremes, and periods of low market participation helps forex participants remain vigilant to instability periods’ inevitable nature. Diligently managing risk accordingly while systematically capitalizing on recurrent patterns grants an edge in the long run through all market conditions.