Summary

- Growth investing is an alternative strategy that focuses on companies with strong revenue and earnings growth potential.

- Successful growth stocks often have competitive advantages like strong brands.

- Patience is crucial in growth investing, as it can take years for their full potential.

- Diversification is important in reducing risk when investing in growth stocks.

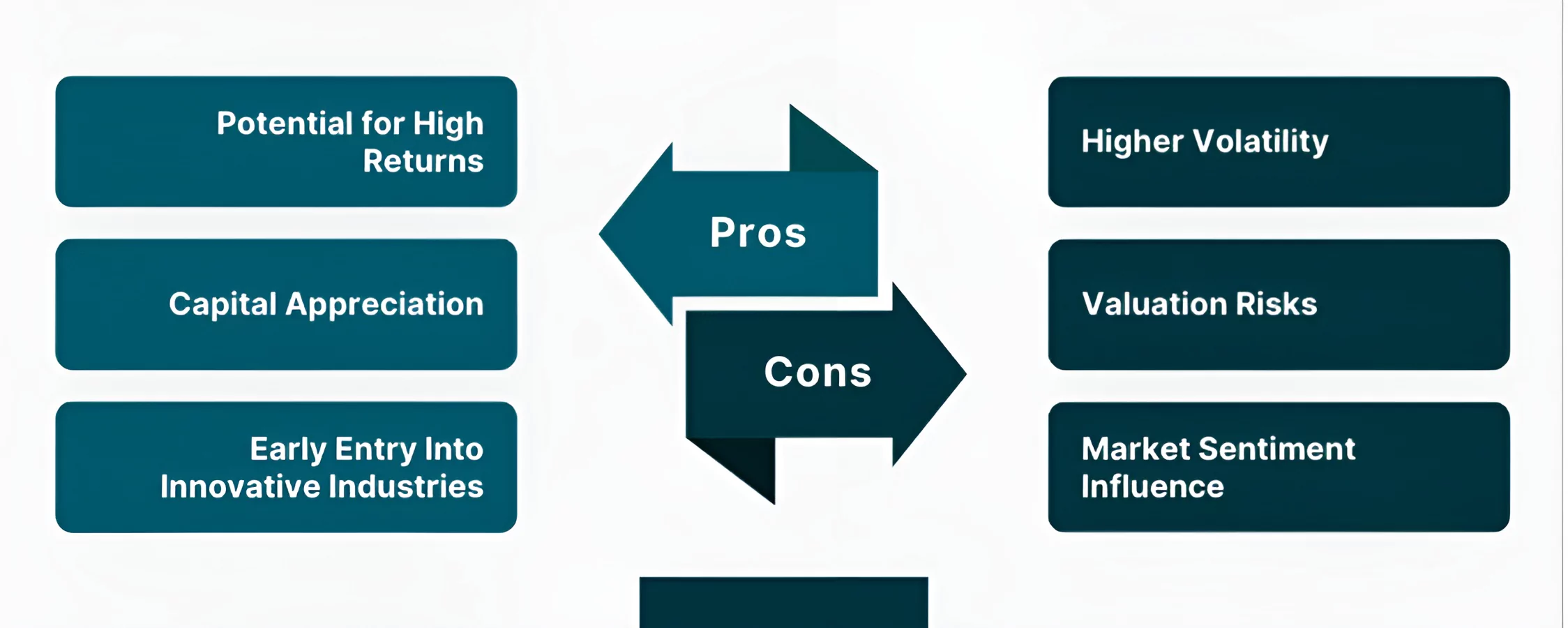

In today’s evolving markets, focusing solely on dividends or value factors may no longer be enough to achieve robust long-term returns. An alternative strategy gaining popularity is emphasizing companies with strong revenue and earnings growth potential – also known as growth investing. Though riskier than some other styles in the short run, a growth approach can deliver outsized gains when exposures are well-researched and diversified. Let’s explore the basic concepts behind growth investing and how beginners can incorporate this dynamic strategy.

Growth vs. Value

To better understand growth investing, it helps to compare it to value investing. Value investors seek out companies trading at prices noticeably below reasonable estimates of their intrinsic worth, with an expectation that over the long run, the market will recognize this discounted valuation and the share price will eventually rise to match or exceed what business fundamentals support. Growth investors, on the other hand, are typically more willing to pay higher relative prices compared to current earnings and book value for select businesses that have demonstrated an ability to consistently achieve high rates of expansion in both revenues and earnings.

Rather than fixating too intensely on commonly used valuation metrics like the price-to-earnings ratio or price-to-book value, growth investors tend to place greater emphasis on developing research-backed predictions concerning a company’s anticipated long-term future growth trajectories based on assessments of competitive advantages, addressable market opportunities, business model strengths, management talents and other qualitative attributes that could sustain above-average gains over extended time horizons.

Growth Candidate Qualities

Successful growth stocks often exhibit strong competitive advantages that set them apart from rivals, such as widely recognizable and trusted brands, proprietary technologies possessing significant barriers to entry, economies of scale in manufacturing or distribution that reinforce pricing power, powerful network effects that enhance user base growth organically, or exclusive access to unique distribution channels.

Their management teams are also often adept at efficiently reinvesting a high proportion of free cash flow earnings back into strategically expanding revenues, taking greater market share from competitors, and sustaining high rates of top-line gains and margin expansion over extended timeframes. Growth sectors that warrant investigation typically center around key areas demonstrating long-duration secular trends upwards, such as cloud computing infrastructure, biotechnology innovations, digital payments modernization, renewable energy buildouts, and others primed for sizable gains over the years.

Patience is Paramount in Growth Investing

A core principle of growth investing is patience, as the full potential of high-quality growth companies may not be immediately apparent. It can take years for innovation or market share gains to bear financial fruit. For this reason, growth stocks tend to be more volatile than their value counterparts in the short term. With a long-term horizon, periods of volatility can represent buying opportunities rather than signs to sell. Discipline is crucial – growth investors must closely analyze whether long-term drivers remain intact when share prices fall.

Diversify Diligently

As with any specialized strategy, diversification reduces risk when pursuing growth stocks. Early-stage companies with unproven business models carry substantially more risk than established names. Novice growth investors are wise to limit high-risk stock allocations until they achieve scale and experience. Spreading across multiple growth sectors and industries lowers the impact of any single holding’s underperformance. Rebalancing regularly ensures exiting appreciating positions to fund new opportunities.

Consider Fundamental Factors of Growth Investing

Rather than speculate based solely on factors like momentum, valuations, or chart patterns, growth-focused investors assess qualitative aspects like leadership competence, sustainability of competitive edges, earnings trajectory, and cash flow generation. Strong revenue, expanding margins, rising return on equity, and prudent reinvestment of cash flows back into the business are all signs of durable growth companies worth considering as long-term holdings. Diligence in these underappreciated qualitative factors helps differentiate prudent growth candidates from overhyped stories.

Growth investing demands more effort given the dynamic evaluation of business models and competitive positioning over time. But for the patient, disciplined long-term investors, emphasizing companies cultivating robust growth runways can offer a highly rewarding complement or alternative to value strategies in today’s innovation age. Starting small and diversifying widely builds expertise for greater success down the road.