The foreign exchange (forex) market is unique in that it operates continuously across different global trading centers, providing traders worldwide with opportunities to trade currencies 24 hours a day during the week. However, understanding when the major forex centers open and close is crucial for efficiently navigating this vast decentralized over-the-counter (OTC) market. This in-depth guide will examine the key trading hours for North America, Europe, Asia, and elsewhere, as well as explore how different market periods impact opportunities and strategies. By grasping forex market hours, traders can trade more effectively and make informed decisions.

North American Trading Session

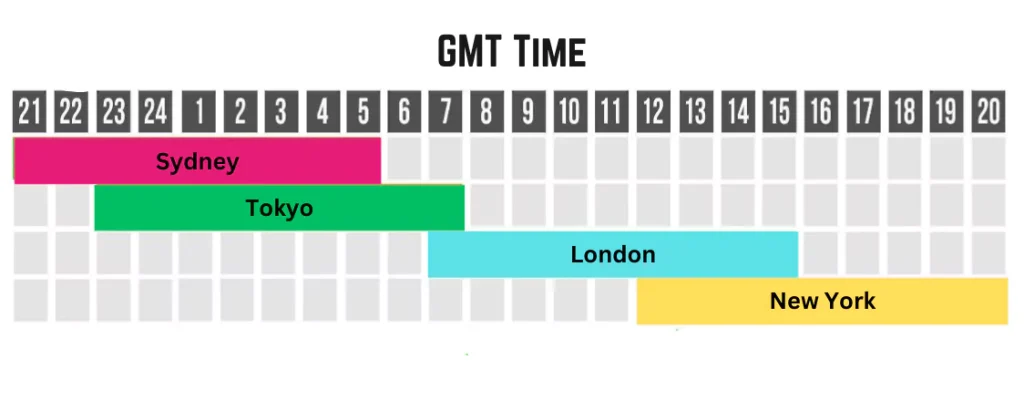

The North American forex session officially runs from 08:00 EST to 17:00 EST each weekday, encompassing the trading hours of both the New York and Toronto stock exchanges. This seven-hour period sees some of the highest volume in the market as the United States dollar (USD) is actively traded. During this time, economic news releases from the United States tend to have an outsized impact on USD currency pairs like EUR/USD. Traders in North America have easy access to attractive trading conditions spanning both the European and Asian sessions. News events from Canada may also move the Canadian dollar around this time.

European Trading Session

The European trading session overlaps both with the end of the North American session and the beginning of the Asian session. It runs daily from 02:00 to 12:00 GMT. Major European centers influencing trading include London, Frankfurt, Paris, Zurich, and Geneva. Economic reports from powerhouses like the UK and Eurozone significantly impact pairs like GBP/USD and EUR/USD during these hours. Traders in Europe enjoy liquid conditions and favorable spreads spanning several hot market sectors. Lower volatility also occurs evenings when European traders log off before Asian players ramp up.

Asia-Pacific Trading Session

Asia brings the global forex market to a close each day, with its session lasting from 19:00 GMT until 03:00 GMT the next morning. Major financial centers driving activity include Tokyo, Hong Kong, Shanghai, Sydney, Singapore and Mumbai. A large percentage of cross-currency pairs see significant price action during these hours as economic data from countries like Japan, China, and Australia and commodity producers filter in. Traders down under benefit from active conditions during their regular working day. However, liquidity thins as the Asian day wraps up in the early morning GMT hours.

Overlap Between Sessions

The global nature of the forex market means that as one region’s day ends, another’s begins, keeping the market functioning continuously. The European and Asian sessions overlap during London and Hong Kong hours. Likewise, Asian and American sessions converge as Asian traders finish up and North Americans start the day. These overlap periods see robust liquidity appealing for scalping short-term moves. Economic reports issued during transitions between regions may generate heightened volatility. Major central bank meetings also take place during these synchronous times.

Weekend Currency Trading

Unlike other financial markets that observe Sunday closures, the forex market remains open over the weekend but with limited liquidity and higher spreads. This is because while most banks and major institutions cease trading on Friday afternoons through Sunday evenings, alternative market makers continuously provide currency quotes. Trading activity drops off sharply with Asian markets closed for the weekend. Traders should watch out for gap openings on currency pairs upon Sunday and Monday reopenings as unexpected news could trigger sharp reactions.

Trading Considerations

Understanding how activity levels vary throughout market sessions is critical for strategic work scheduling, such as completing technical analysis, planning upcoming trades, and optimally entering or exiting positions. The most liquid and turbulent periods are ideal for short-term scalping methods or news-focused event trading, whereas slower nighttime sessions allow traders to keep open positions and avoid the risk of significant surprise gaps.

However, focusing trading efforts entirely on high-impact periods exposes one to an unusually large number of occurrences that have the ability to derail well-laid plans. A balanced approach to trading across numerous sessions allows for the exploitation of intraday opportunities when liquidity is high while avoiding disturbance from overnight price surges. Overall, responding flexibly to variations in global participation levels and trading in rhythm with prevailing market conditions increases the likelihood of long-term success.

News Trading Strategies

Major economic statements from globally influential countries offer enough opportunities for directional, short-term trading around them. Nonetheless, given the numerous complicated macroeconomic forces at play, accurately projecting how the market will react is extremely challenging. Traders can choose to scale into smaller initial pilot positions in anticipation of the news, then selectively build on aggressively if large moves in the expected direction materialize using pending stop limits.

Partial closes can also be used to lock in gains or reduce losses if reactions do not go as expected. However, focusing primarily on these high-profile events leaves one extremely vulnerable to unforeseen whippy price movements that could otherwise be avoided. Patience and selectivity are ultimately beneficial to news traders since they help avoid impulsive reactions that increased volatility may cause amid the commotion around significant releases.

Conclusion | Forex Market Hours

Understanding the ongoing global forex market hours and dominant sessions helps make your trading judgments more effective. Understanding how liquidity dips and surges help in efficient order placement during low-risk periods. Without constant predictability, news trading requires extra caution. Overall, aligning with global trading cycles increases prospects for profitably navigating short-term currency changes. Flexible market participation that respects natural liquidity patterns keeps traders well-positioned for a variety of trading styles. Mastering market hours provides a significant advantage.