One of the most popular and successful strategies for creating long-term wealth is real estate. By making thoughtful real estate portfolio, people can leverage their equity and provide steady income through capital growth or rental yields over time. However, building a diverse real estate portfolio requires careful preparation and handling. This thorough guide describes the important processes and best practices for establishing a successful property investment portfolio according to individual goals and risk tolerance.

Defining Your Investment Objectives

As you are buying your first home, consider your long-term goals and limitations. Are you looking for ways to enhance your real estate portfolio through higher resale values, tax benefits, or sources of rental income? Establish the intended holding periods, the desired annual returns, and the size of the portfolio. Guidelines for strategic asset selection that balance opportunities and limits are established by evaluating aspects such as liquidity demands, time commitment, and risk tolerance levels. Having goals in writing gives guidance when assessing possibilities as a portfolio grows.

How Can You Get Started?

Purchasing an initial income-producing asset that satisfies analytical criteria is the first step in starting to develop a real estate portfolio. Owner-occupied multifamily homes provide a rent-free lifestyle and the opportunity to create equity through mortgage paydown, which might be appealing to inexperienced investors. Use first-time buyer programs to save money upfront compared to market-rate mortgages if you qualify. Overcapitalizing properties can be avoided by sticking to a strict budget and setting aside money for renovations. Getting your foundation established creates credibility, broadens the field of investments, and points out related follow-up acquisitions.

Which Markets Are Worth Choosing?

Thoroughly investigating specific metropolitan statistical regions’ economies, demography, and property fundamentals reveals areas with favorable long-term prospects. To maintain rental demand outlooks, consider factors such as population and employment growth, average rents, recent patterns in the appreciation of selling prices, and new building rates. Give priority to established communities with a stable and diverse population that are less likely to see fluctuations in employment rates. By carrying out in-house market research, investors can choose particular niches that enhance real estate portfolio diversification tactics.

What Property Types Diversify Risk?

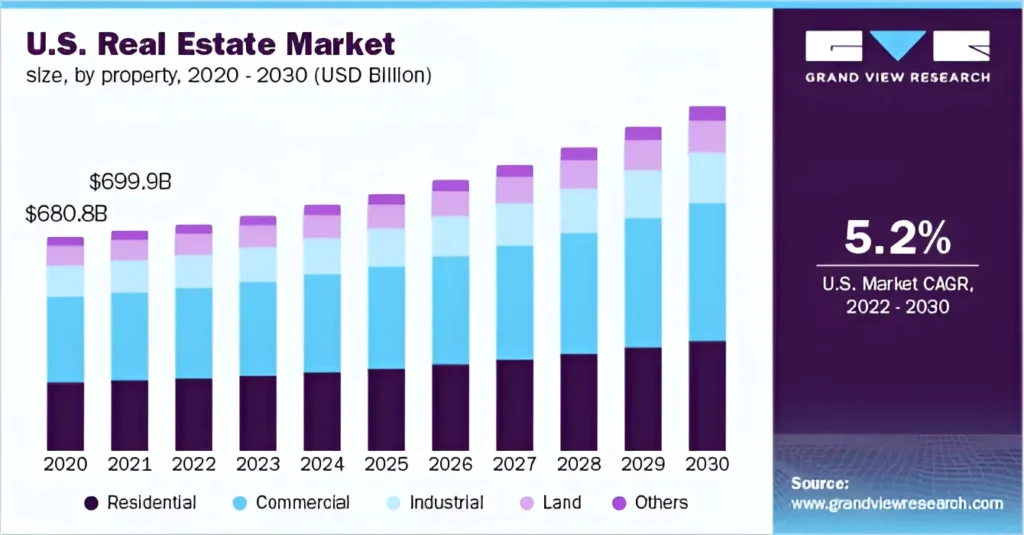

The reduction of cyclical industry or localized market risks can be accomplished by carefully choosing a variety of property types across asset classes, even within target areas. Because of consistent demand drivers, residential assets such as single-family homes, condominiums, and multifamily complexes make up core holdings. Revenue sources are expanded by complimentary commercial assets that include self-storage, industrial, and retail spaces. Once scale justifies overhead, diversification can take on an international dimension through partnerships in foreign development projects, crowdfunded agreements, and REIT positions. True diversified portfolios perform better than their undiversified counterparts in both prosperous and poor economic cycles.

How Should Properties Be Acquired?

Preferred acquisition channels are determined by experience, which balances control and risk when building a real estate portfolio. Buying investment-grade homes through local brokers, where sellers finance sections using equity, is beneficial for first-time investors. The advanced exposure includes locating fixer-upper properties with good cash flow that can be repositioned through capital renovations. Investors are positioned to profiteer by “assigning” purchase commitments to prospective buyers through whole selling contracts. Off-market opportunities are found through leveraging contacts, and joint ventures share resources and experience. When assessing the need for repairs, enclosures and REO assets should be evaluated by experts in the field. Thoroughly evaluating every approach enables investors to acquire properties that are strategically aligned in the long run.

What Renovation Considerations Apply?

Repositioning properties with value-added increases net operating income and asset values by leveraging upgraded properties that command higher rents. A thorough budgeting process guarantees affordability and prevents cost overruns. Hire reputable, certified general contractors who will clearly define the work scope, timelines, and billing. Finding trustworthy networks of subcontractors that can cut expenses without compromising quality encourages long-term tenant retention. Whenever possible, increasing margins also involves utilizing partner or personal skill sets that include renovation-related costs. Maximizing rent premiums and resale values involves giving priority to energy-efficient renovations, designer fixtures, smart home features, and curb appeal.

How Should Properties Be Managed Actively?

Sophisticated property management systems are established to keep revenue-generating assets operating at peak efficiency and boost long-term returns. When possible, assign daily operations to established local businesses; nonetheless, owners maintain control and the ability to make strategic decisions. Use technological platforms to convert labor-intensive manual operations into efficient workflows. Utilize data-driven technologies to proactively handle maintenance requirements while maintaining a favorable tenant and investor experience. Strong screening, timely issue resolution, proactive program implementation, and strategic marketing of available spaces provide high occupancy and renewal rates, which in turn generate revenue flows.

How Do You Optimize Financing Strategies?

By using inexpensive borrowed capital wisely, portfolios with cautious loan-to-value ratios increase returns. Place commercial loans on top of traditional mortgages and use the equity in individual properties as further security. Prioritize self-amortizing, fixed-rate terms to protect cash flows against inflation. When appreciation values exceed debt balances, refinance to extract and recycle equity for future projects. Increase the percentage of financed properties while aggressively aligning debt balances without going overboard and jeopardizing stability. Through the consolidation of assets, rate optimization, and successful increase in equity multiples, portfolio-scale finance compounded net worth dramatically over time.

Conclusion | Building A Real Estate Portfolio

The art of strategic real estate portfolio investing requires a great deal of planning and carrying out. Nonetheless, a strong basis for multi-decade wealth building is laid by dedication to tried-and-true approaches for market targeting, asset diversification, property optimization, and systematization. Changing with the times and adapting allows you to take full advantage of chances even when the social and economic environments change. When these ideas are used with discipline and patience, the results surpass passive real estate portfolio returns across whole real estate investment cycles.

Disclaimer

All investments and strategies involve risk of loss, and nothing featured on Finance Today guarantees positive results, profit or protection against losses. Finance Today does not endorse any companies, products, or services that may be referenced on this site. Readers should not make any financial decision or strategy based solely on the information provided here.