Building a passive income stream through dividend investing is a time-tested wealth-building strategy. While dividend yields on individual stocks may seem small, compounding and reinvesting those dividends over long periods leads to substantial cash flow. Choosing stocks with stable payouts, wide moats, and histories of raising dividends yearly can create a growing passive income for investors. In this guide, we will explore the metrics to analyze and top dividend stocks to consider for a passive income portfolio.

Key Criteria for Dividend Stocks

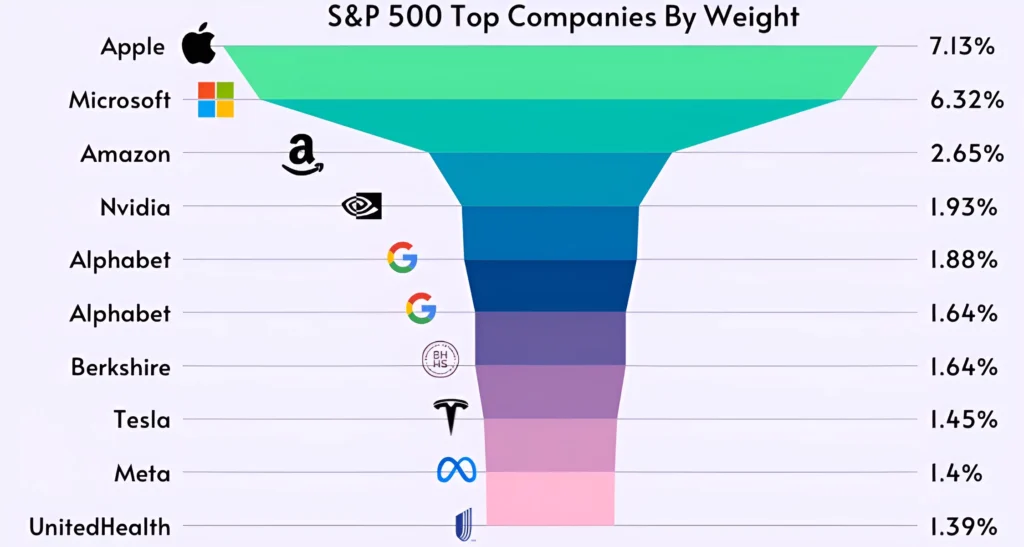

When selecting dividend stocks to generate passive income streams, investors should focus on several key criteria. One important metric is the dividend yield, calculated by dividing the annual dividend amount by the stock price. This measures the income generated versus the total investment amount. In general, stocks with higher dividend yields can provide greater income, so yields above the S&P 500 average of approximately 1.5% are preferable. Stocks generating yields of 3-4% or more indicate larger dividend payouts relative to the share price.

Another key ratio is the payout ratio, which compares the dividend payment amount to the company’s earnings per share. Low payout ratios under 50% indicate there is ample room for the company to continue growing its dividend as earnings expand. However, very high payout ratios over 75% may be less sustainable in the long run if earnings decline. Steady earnings growth enables consistent dividend growth.

When researching dividend-paying stocks, investors should look for companies with long histories of paying and raising dividends consistently every year, even through recessions and market downturns. The “Dividend Aristocrats,” an elite group of S&P 500 companies with 25+ consecutive years of dividend growth, represent prime examples of stocks with shareholder-friendly income policies. Stocks with proven track records of dividend consistency provide greater assurance that regular payouts will continue.

Analyzing key financial metrics like revenue and earnings growth, cash flow generation, and manageable debt levels is also important when evaluating dividend stocks. The strongest dividend payers possess wide economic moats, healthy growth rates, and solid funds to support their payouts. Financial strength and competitive advantages give companies the ability to sustain dividends through all market cycles.

What Are The Top Dividend Stocks to Consider

Now that we’ve covered the criteria to analyze, here are some of the best dividend stocks across various sectors for building passive income streams:

In the consumer staples sector, Procter & Gamble is a stalwart dividend payer. With 65+ consecutive years of dividend growth, a current yield of around 2.5%, a moderate payout ratio, and recession-resistant products, P&G has an impressive dividend track record. Another excellent dividend payer is Johnson & Johnson in the healthcare sector. J&J has increased dividends for 60 straight years supported by its diversified business model and AAA credit rating. Its 2.5% dividend yield signifies stability.

For utility stocks, NextEra Energy is the world’s largest utility company and has grown its dividend for over 25 years. It offers a yield of around 2% with plenty of room for continued payout expansion. Specializing in commercial real estate, Realty Income Corporation pays a generous 4% yield monthly. Its rents generate steady cash flow funding payouts that have increased for 28 consecutive years.

Even some technology stocks like Texas Instruments provide healthy dividend income. With its powerful market position in analog semiconductors and 18-year dividend growth history, TXN’s 3% yield makes it a standout. In the telecom sector, AT&T’s heavy cash flows support its fat 6% dividend yield. AT&T has increased its payout for 37 straight years, the longest streak among S&P 500 companies.

Creating a Passive Income Portfolio

Constructing a well-diversified portfolio spanning different sectors mitigates risk while providing multiple income streams across the business cycle. Reinvesting dividends speeds up compounding. Investors should also choose stocks with varied dividend payout schedules to receive income every month rather than quarterly. For instance, Realty Income pays monthly while many stocks pay quarterly. Smoother income distributions lower volatility.

Most importantly, maintaining discipline and patience is essential when dividend investing for passive income. Have the persistence to hold quality stocks long enough to realize the power of compounding. Resist chasing unsustainably high yields from companies on shakier financial footing. Adhering to criteria focused on established dividend payers with sound fundamentals, competitive advantages, and growth outlooks leads to the best results over time.

Conclusion

In conclusion, dividend investing requires analyzing fundamentals and thinking long-term. But assembling a portfolio of stocks like the dividend aristocrats and kings – companies with strong moats, excellent total return histories, and perpetually rising payouts – can generate an exponentially growing cash flow stream. Done properly, dividends can eventually fund all of life’s expenses simply by harnessing the power of compounding over decades. Dividend stocks remain one of the surest routes for achieving true passive income.