When it comes to investing in the stock market, some of the most respected and sought-after companies are known as “blue chip” stocks. But what exactly does that term mean and how does it apply? In this article, we will explore the definition of blue chip stocks and what characteristics make them a popular choice for investors seeking stability and growth potential.

What Are Blue Chip Stocks?

The designation of “blue chip” originated from the highest-value chips used in gambling. Applied to companies, blue chip stocks are those issued by well-established, nationally recognized, and financially sound large companies. These are typically large-cap companies that dominate their industries and have strong brands, products, and global market presence.

Many blue chip stocks traded on the S&P 500 index, an index of 500 large-cap U.S. stocks seen as a benchmark for overall market health and performance. However, not all S&P 500 components are necessarily blue chips and some blue chips trade on other major indexes like the Dow Jones Industrial Average. In general, though, you can think of blue chip stocks as belonging to household name corporations.

What is Considered a Blue Chip Stock?

Large market capitalization is a defining attribute of blue chip stocks. These companies typically have a market value of over $10 billion, demonstrating substantial financial strength, resources, and stability. Their large size provides resilience through changing economic conditions. A proven track record of growth over long periods is another hallmark of blue chips. They have historically shown sales, earnings, and dividend growth spanning decades—often 50 years or more. This illustrates their ability to perform well through different cycles.

Strong balance sheets with high credit ratings also set blue chips apart. They generally have robust cash reserves and low debt levels, allowing them to better weather economic downturns and periods of market turbulence. This financial clout provides security for shareholders. Dominant brand names and industry leadership are supported by large, loyal customer bases and sustainable competitive advantages. Their multinational scale and geographic diversification across many regions help guard against impacts from localized economic problems in any one area.

Paying steadily rising dividends for generations is another characteristic. A legacy of profit-sharing through steadily paid or incrementally growing dividends over decades fosters stable, reliable returns for long-term shareholders.

Universal household name recognition and trusted brands also exemplify blue-chip status. Their well-known brands engender confidence from investors seeking stability, particularly during periods of increased market volatility or uncertainty. These qualities exemplify the leadership, financial strength, and stability that blue-chip companies achieve within their industries.

What Are Examples of Common Blue Chip Stocks

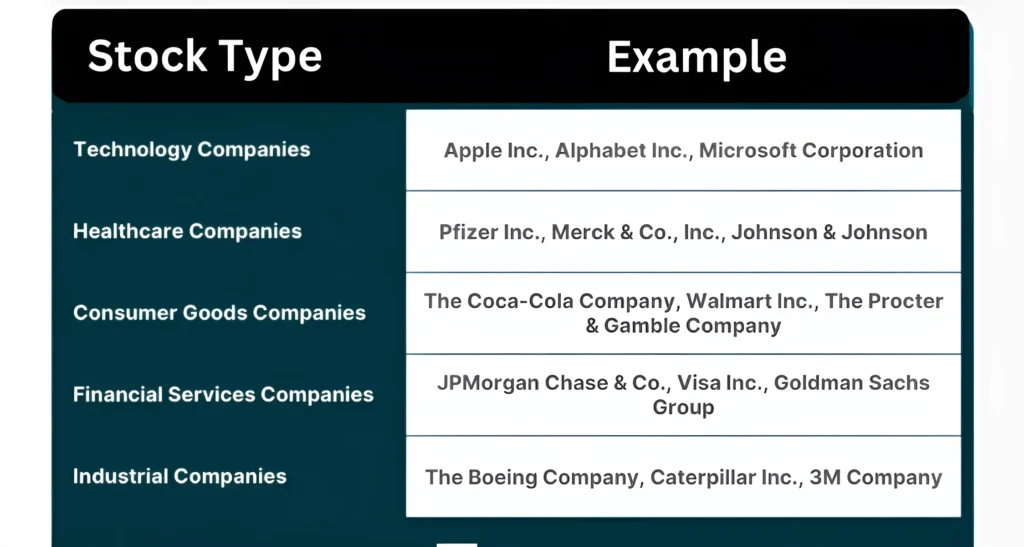

Some of the most well-known and consistently performing blue-chip companies traded on stock exchanges today include:

- Johnson & Johnson (JNJ) – Global healthcare and consumer products giant.

- Coca-Cola (KO) – Iconic worldwide beverage brand with a huge market share.

- Procter & Gamble (PG) – Leading global consumer goods producer. UnitedHealth Group (UNH) – Largest health insurer in the United States.

- Walt Disney (DIS) – Dominant global media and entertainment powerhouse.

- Microsoft (MSFT) – Trailblazing technology software developer.

- PepsiCo (PEP) – Multinational food and beverage leader.

- Visa (V) – Top worldwide electronic payments network.

- McDonald’s (MCD) – Enormous fast food chain with huge brand recognition.

- Intel (INTC) – Semiconductor and microchip innovator.

The stability and reliability of these corporate giants are why blue chips are considered a classic haven in turbulent economic environments. Their scale enables weathering difficulties that could trip up smaller competitors.

What Are The Benefits and Risks of Investing in Blue Chip

Of course, nothing in the stock market is risk-free. Here are some key benefits and potential risks to consider with blue chip stocks:

Benefits:

– Less volatile than small caps due to strong financial positions.

– Have historically outperformed the overall market in the long run.

– Pay steady dividends through economic cycles.

– Widely followed, making analysis and valuation easier.

Risks:

– May have more limited upside gains than smaller companies.

– Giant size makes transforming business models more difficult.

– Still subject to broader macroeconomic and industry conditions.

– At the mercy of competition and technological disruption in the long term.

– Individual companies can fall from grace due to mismanagement.

So while blue chips are lower risk on an individual basis, diversifying across sectors is still prudent. As with any stock, doing thorough research is important before buying or holding shares over long periods.

Should You Add Them To Your Portfolio?

Blue chip companies are typically a great starting point for a key holding in a portfolio for moderately to cautiously conservative investors who want consistent, income-oriented returns over volatile gains. They are appropriate for income and retirement investing strategies due to their robust financial standing and dividend profiles. To balance risks and returns, more aggressive investors can add smaller high-growth equities to their blue chips. In general, blue chips offer a strong foundation for accumulating wealth over time.

Conclusion

In conclusion, investors can be confident in choosing businesses from the highly selective blue-chip tier of sizable, globally recognized enterprises. Due to their sound financial standing, enduring brands, and track record of generating returns for shareholders, this class of stocks tends to provide stability even when faced with periods of market volatility. These characteristics allow for their continued popularity in buy-and-hold and balanced investing approaches.

Disclaimer

Finance Today strives to provide our readers with factual, informative articles and resources on finance, investing and business. However, the contents featured on this website, including any articles, market commentary, tracks, trades, or other information, should not be considered personalized investment advice.