What Are Cyclical Stocks?

A stock is considered cyclical if its returns fluctuate corresponding with the state of the economy. These equities typically do particularly well when the economy is doing well. However, these cyclical stock prices are expected to decline during recessions.

Because the economy has a significant impact on these equities, it also has a significant impact on the portfolios of investors who have capital invested in these stocks. When the economy is booming, an investor who invests largely in cyclical companies may have positive returns, but they may also see declines when the economy is in decline.

How To Identify A Cyclical Stock

Cyclical equities typically represent ownership stakes in businesses that provide non-essential or consumer discretionary goods and services.

The amount that consumers spend on these items tends to rise while the economy is expanding; on the other hand, when the economy starts to contract, these items are typically the first to be cut from a budget.

Compared with non-cyclical equities, which typically perform consistently no matter how the economy is doing as a whole, cyclical stocks are what we will compare them to.

Examples Of Cyclical Stocks

Occasionally, cyclical stocks are further divided into durables, nondurables, and services. Businesses that produce or distribute durable goods do so because their products are expected to last longer than three years. Automobile manufacturers like Ford, appliance producers like Whirlpool, and furniture producers like Ethan Allen are among the businesses that compete in this market category.

Future economic success can be predicted by looking at the indicator of durable goods orders. When orders for durable goods increase in a given month, it may forecast better economic growth in the months that follow.

Producers and distributors of nondurable goods make consumer products with a three-year life expectancy or less. Retail chains like Nordstrom and Target as well as the sportswear company Nike are some examples of businesses that participate in this industry.

Since these businesses don’t produce or sell tangible goods, services fall under a different category of cyclical stocks. Instead, they offer services that let people enjoy themselves through travel, entertainment, and other leisure pursuits. Walt Disney (DIS) is one of the most well-known businesses in this sector. Companies that operate in the emerging digital space of streaming media, like Netflix, also fall under this category.

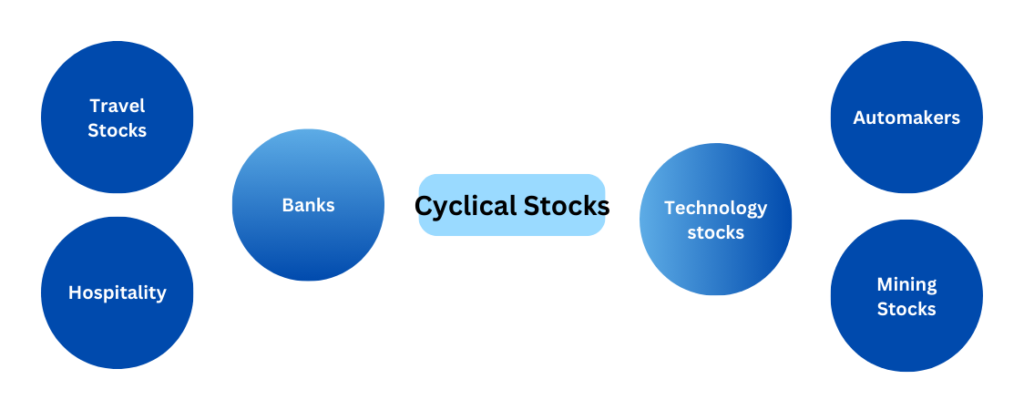

Cyclical Stock Sectors

Looking at the industries in which cyclical stocks typically operate will probably help you better understand what they represent.

Travel Stocks: Companies in the travel sector, such as airlines, cruise line operators, and hotels, typically do better when the economy is booming. Since most people consider taking a vacation to be somewhat of a luxury, it makes sense that during a recession, revenues for businesses in this sector may decrease.

Hospitality: During economic downturns, consumers are less likely to spend income on eating and drinking out, which causes shares of restaurants, bars, and other hospitality businesses to frequently decline.

Banks: The banking industry is cyclical. People spend more income and consequently borrow more capital from banks to do so during times of economic expansion. The opposite is true, though, when the economy experiences a recession.

Automakers: A car is a great example of a purchase that is very likely to be put off during a recession since people would rather keep using their current vehicle.

Technology stocks: Much like automotive products, people are likely to put off buying new technology during hard times, including computers, mobile phones, and gaming consoles. It is crucial to remember, nevertheless, that not all technology equities are cyclical.

Mining Stocks: As the world economy expands, consumer demand increases. As a result, more raw materials are needed to produce goods. Mines producing metals like copper and iron ore typically operate well under these conditions.

Cyclical shares

It’s critical to acknowledge that not all economic downturns are created equal when discussing cyclical shares. Therefore, depending on the specific circumstances, a stock may react to a recession differently even if it is traditionally thought of as cyclical.

The 2020 coronavirus pandemic-related economic slowdown is an excellent and recent illustration of this. While many traditionally cyclical stocks, like banks, struggled, many others, like Amazon, excelled as people turned to online shopping to relieve lockdown boredom.

Non-Cyclical Stocks

Non-cyclical stocks consistently perform better than the market when economic growth slows. They could also be referred to as consumer staples due to the fact that they are always in demand as necessities.

Non-cyclical assets are often successful regardless of economic trends because businesses produce or offer services that humans will always require, like food, power, water, and gas. The stocks of businesses that offer these goods and services are frequently referred to as defensive stocks because they can shield investors from the effects of a recession. They make great investment opportunities when the economy is struggling.

For instance, while non-durable home supplies like toothpaste, soap, shampoo, and dishwashing liquid might not appear like requirements, they are essential. Most people don’t believe they can wait until next year to take a soapy shower.

Utility companies are yet another example of non-cyclical businesses. People need heat and electricity for themselves and their families. Due to the fact that they provide a service that is commonly used, utility companies endure little volatility and moderate growth. A crucial fact about non-cyclical equities is this. Although they offer safety, their costs won’t soar as the economy expands.

Cyclical Stocks Vs Non-Cyclical Stocks

Cyclical stock performance frequently reflects the health of the whole economy. However, this is not true of noncyclical stocks. Regardless of the economic trend, even during a slowdown, these equities frequently outperform the market.

Defensive stocks are another name for noncyclical stocks. These stocks are representative of the consumer necessities industry, which offers goods and services that customers continue to use and buy even during recessions.

Businesses like Walmart that deal with food, gas, and water are examples of noncyclical stocks. Investors stand to gain significantly by including noncyclical stocks in their portfolios, as doing so helps guard against losses sustained by cyclical businesses during a recession.

Conclusion | Cyclical Stocks

You might be wondering why anybody wants to add stocks to their portfolio that are likely to decrease in value if there is an economic downturn since you understand what cyclical stocks are. Some investors who are afraid of risk choose this strategy, choosing investments that only operate in defensive sectors and that are not subject to fluctuations in line with the sentiments of the market as a whole.

However, many successful portfolios frequently include both cyclical and non-cyclical shares. Investment portfolio diversification is crucial, and while cyclical shares may need extra care from investors, it may not be wise to ignore them altogether.