In the world of cryptocurrency and blockchain, decentralized autonomous organizations, or DAOs, have gained popularity in recent years. Nonetheless, there is still significant ambiguity about the precise nature, operation, and intent of DAOs. This article attempts to address some of the most frequently asked topics to give a thorough introduction and explanation. We’ll examine their key traits, working procedures, applications, and possible effects on different industries.

What Is a DAO?

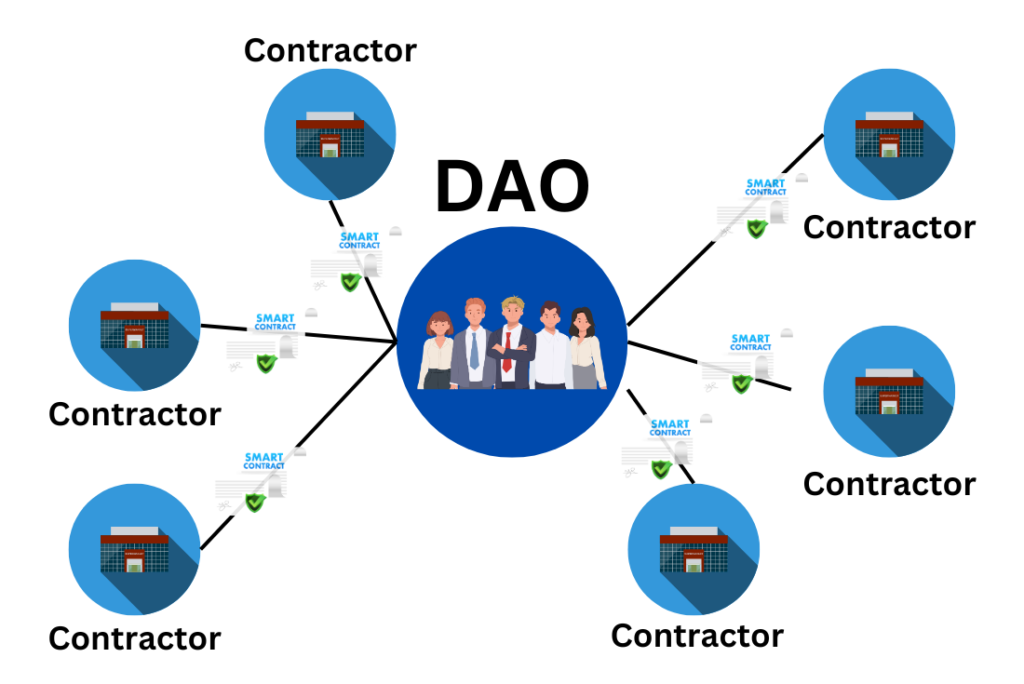

A decentralized autonomous organization (DAO) is characterized by its laws stored in a transparent computer program, managed by its members, and independent of a central administration. Through on-chain voting, DAO members collaboratively make choices as a fully autonomous, leaderless organization. DAOs have complete control over how they run since all of their policies and procedures are codified and saved on the blockchain. In place of conventional management hierarchies or boards of directors, DAOs enable like-minded people to band together and work together to fund projects, develop decentralized applications or services, regulate tokens, or make investment decisions.

How Do DAOs Work?

DAOs are technically powered by smart contracts that are housed on blockchains such as Ethereum. The DAO’s operational logic and rules are contained in smart contracts, which are open to the public. Holding a DAO’s governance token, which grants voting rights, entitles members to join. The token holders then vote on all important decisions; for a proposal to be approved, a quorum and a majority of votes are needed. On fundamental issues such as funding distribution, protocol updates, income sharing, and other community decisions, token holders can suggest and cast votes. Transparency, independence, and group decision-making without centralized control are made possible by this decentralized governance paradigm. Additionally, DAOs make available to the public all financial blockchain transaction records and immutable blockchain management rules.

How Are DAO Decisions Made?

As mentioned, all major decisions within a DAO are subjected to a voting process by token holders. There are typically a few different voting mechanisms employed:

- On-chain voting: Members cast their votes directly on the blockchain through transactions, requiring users to manage private keys. This provides fully auditable results but favors more technical members.

- Off-chain voting: Voting is done through a front-end interface without needing private keys. Results are then committed to the blockchain through a representative. Easier for general participants but reduces full transparency.

- Quadratic voting: Voters can allocate a set amount of “tokens” to proposals, with each additional token costing more. This discourages voter monopoly while empowering the most engaged members.

- Liquid democracy: Members can delegate their voting power and tokens to trusted representatives. Encourages specialization while still maintaining decentralized governance.

The specifics vary by DAO but in general, these voting systems determine the collective will and direction of the organization.

How Are DAOs Funded?

Most DAOs require an initial funding source to kickstart their activities and operations. Some common models for DAO financing include:

- Token sales: DAO launches its native governance token on a blockchain and sells a portion to the public. These token holders then govern the DAO.

- Grants: DAO applies for and receives financial support from blockchain protocols, VCs, or accelerators to fund initial projects.

- Work for tokens: Service providers are compensated in the DAO’s tokens for their contributions like development work.

- Crowdfunding: DAO launches campaigns on platforms like Kickstarter or Mirror to fundraise for specific initiatives.

- Treasury funds: DAO has funds already generated from past funding rounds, revenues, and asset holdings to allocate toward new ventures.

The funding mechanisms allow DAOs to pool resources and delegate capital towards value-creating activities as governed by token holders.

How Secure Are DAOs?

Given they are managed through open-source code, one concern around DAOs has been the possibility of security vulnerabilities that could compromise funds or operations. However, modern DAOs employ numerous safeguards to bolster security. Such as smart contract audits. Contract code undergoes rigorous review by specialized firms to identify flaws before deployment.

Also, a DAO holds insurance policies that can reimburse members in the case of attacks or exploits. They also require multiple private keys to authorize high-risk transactions like withdrawals which increases their security. The admin functions allow pausing compromised contracts until fixes are implemented. As a large network, members constantly review activity for irregularities.

A DAO maintains and upgrades the codebase via community-approved governance to patch vulnerabilities. While no system is perfectly secure, DAO protocols and oversight counter the most critical risks if properly engineered and supported by capable communities. Overall security has improved greatly in recent years.

What Industries Are Impacted by DAOs?

DAOs have the potential to disrupt and decentralize industries ranging from media and finance to charity and governance. Here are a few sectors already seeing impact:

- Creative: DAOs like ConstitutionDAO crowdfund projects and compensate artists, reducing middlemen cuts.

- Venture capital: DAO VC funds like Syndicate autonomously fund startups via token voting, lowering barriers.

- Gaming: Play-to-earn games and virtual worlds governed as DAOs empower player ownership.

- Marketplaces: DAOs build decentralized versions of platforms like Etsy or Kickstarter without centralized listing fees.

- Social media: Blockchain social apps like Fetch.ai built as DAOs monetize data cooperatively instead of via ads/subscriptions.

- Governance: DAOs experiment with new models of governing cities/communities through participatory platforms.

As blockchain use grows, expect DAOs to challenge centralized power structures across sectors by decentralizing decision-making and promoting community ownership. Many see this as the next stage of the internet’s evolution.

Conclusion

To sum up, DAOs offer an innovative framework for setting up cooperative groups and distributing resources in an open, decentralized way. DAOs eliminate the manual monitoring and centralized control that come with traditional organizations by implementing rules, governance, and administration through smart contracts on the blockchain. Their use is expanding across industries to fund startups, administer protocols, develop applications, and test out new governance models now that strong security precautions are in place.

Even though they’re still developing, DAOs have a lot of potential to change how communities and organizations function by allowing for complete autonomy and group involvement. Anticipate the introduction of numerous more ambitious DAO efforts in the coming years as blockchain networks spread throughout the world.

Disclaimer

All investments and strategies involve risk of loss, and nothing featured on Finance Today guarantees positive results, profit or protection against losses. Finance Today does not endorse any companies, products, or services that may be referenced on this site. Readers should not make any financial decision or strategy based solely on the information provided here.