In the world of investment, diversification is key to managing risk and maximizing returns. One popular tool that allows investors to gain exposure to a wide range of international markets is International Exchange-Traded Funds (ETFs). These investment vehicles have gained significant popularity in recent years, offering investors a convenient and cost-effective way to access global markets without the need for individual stock selection.

In this article, we will explore the concept of International ETFs, their benefits, and considerations for investors looking to diversify their portfolios across international borders. By understanding the fundamentals of International ETFs, investors can make informed decisions to expand their investment horizons and tap into the potential of global markets.

What are Exchange-Traded Funds (ETFs)?

ETFs are investment funds that are traded on stock exchanges, much like stocks. ETFs track an underlying index or sector and allow investors to efficiently gain exposure to entire markets through a single security. Some key features of ETFs include intraday pricing, low expense ratios compared to mutual funds, tax efficiency, and the ability to be bought and sold anytime the market is open. Many different types of ETFs track domestic and international stocks, bonds, commodities, currencies, and more. International ETFs specifically track markets outside of an investor’s home country.

Why Invest Internationally with ETFs?

There are several reasons why investing internationally through ETFs can provide diversification benefits compared to only investing domestically. International markets do not always move in tandem with one’s home market, so holding foreign assets helps reduce non-systematic risk. Additionally, different countries and regions tend to experience economic expansions and downturns at varying times, so international investing improves resilience over full market cycles. It also allows participation in the growth of emerging and developed foreign economies. While international investments carry unique political and currency risks, broad-based ETFs provide affordable access to diversification across thousands of companies worldwide.

What Types of International Stock ETFs Exist?

Many different flavors of ETFs provide exposure to international stocks, both developed and emerging. Broad-developed market ETFs track indices like the MSCI EAFE and track large and mid-cap companies in countries like Japan, the United Kingdom, France, and others. Emerging markets ETFs focus on developing nations experiencing high growth such as China, India, Brazil, and others. Investors can also target specific regions using Europe or Asia-Pacific ETFs. Country-specific ETFs focus solely on individual nations. Sector or industry ETFs invest internationally in energy, technology, financials, and more. And “all country world” ETFs blend both developed and emerging markets into a truly global stock portfolio.

How do Bonds Fit into an International Portfolio?

Just as domestic bond ETFs offer ballast during stock market turmoil, international bond ETFs further diversify fixed income beyond domestic borders. Like stock ETFs, international bond funds allow exposure to developed markets, emerging markets, or specific regions/countries. They also provide currency-hedged or unhedged options depending on investors’ macro outlooks and risk preferences. Broad, aggregate international bond funds invest across investment-grade government and corporate debt instruments. Specialized ETFs focus on certain credit qualities or maturities as well. Including international bonds in portfolio mixes lowers correlations to domestic stocks and bonds, enhancing risk-adjusted returns.

What Factors Impact Currency Exposure?

Currency exposure is an additional consideration for international ETF investors beyond stock and bond performance. Currency-hedged ETFs employ derivatives to mitigate the impact of a strengthening home currency while unhedged funds fully participate in currency fluctuations. Both approaches carry merits depending on views. A weaker home currency boosts unhedged returns while hedged funds experience less volatility. However, over long periods currencies may or may not fully offset equity returns. Proper portfolio construction requires balancing multiple dimensions including country, regional, sector, and currency diversification.

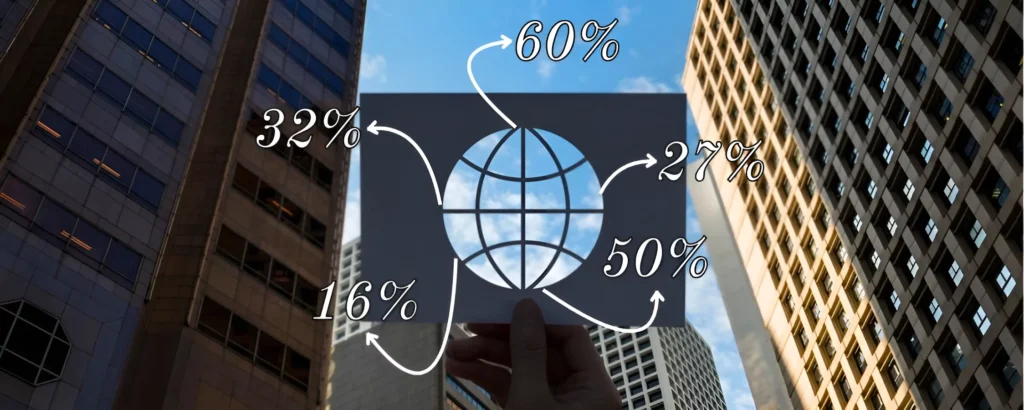

How Much Should a Portfolio Allocate Internationally?

Most financial experts recommend having at least some percentage, typically in the range of 20-40%, of a portfolio invested internationally in addition to holdings in domestic stocks and bonds. This aims to capture the benefits of diversification across different global drivers of returns. However, individual allocations may prudently range from small satellite exposure to upwards of 50% depending on risk tolerance, time horizon, income needs, and other factors. Rebalancing periodically keeps portfolios on strategy as market movements change weights. While international investments carry unique macroeconomic and political risks, low-cost, highly liquid ETFs support prudent global diversification strategies.

What are the Tax Implications of Holding International ETFs?

US tax treatment differs between dividend income sources from international stocks. Qualified dividends from developed market countries potentially enjoy lower maximum income tax rates while emerging market and some other foreign stock dividends pay at regular rates. Additionally, many mutual funds and ETFs are unable to claim benefits from foreign tax credits on dividends. However, many international ETFs strive for tax efficiency through optimizations like avoidance of derivative strategies triggering unrelated business taxable income. Proper record keeping also allows for claiming deductions from foreign taxes incurred. Using ETFs within tax-advantaged retirement accounts eliminates tax implications until distributions occur.

Conclusion | What Are International ETFs?

In conclusion, low-cost international ETFs represent an accessible solution for effectively gaining diversified exposure to the growth prospects of foreign capital markets. Their inherent characteristics of intraday liquidity, low expense ratios, and the ability to precisely target specific countries, regions, and sectors lower the barriers to prudent portfolio internationalization through a single trade.

While foreign investments carry new risks, broadly diversified portfolios experience better risk-adjusted returns and resilience over full market cycles when combining both domestic and international ETFs appropriately. With disciplined evaluation of asset class mixes, periodic rebalancing, and awareness of tax implications, ETFs support balanced allocation suitable to any global investment strategy.