The cryptocurrency market is significantly impacted by any significant event that involves Bitcoin. The Bitcoin halving is one of these occasions. Every BTC trader eagerly awaits the halving to take place and observes how it impacts the price. You can invest wisely in Bitcoin by being aware of when this event occurs and how it affects the market. Continue reading to learn more about the inner workings of Bitcoin and how halving functions.

What Does Bitcoin Halving Mean?

Because of the distinctive digital structure of Bitcoin, digital currency undergoes a fundamental change every four years. In April 2024, it will experience another significant transformation for the fourth time in its 14-year history. Understanding the fundamentals of Bitcoin is essential to comprehending the Bitcoin halving, or “halvening,” as some call it.

Only 21 million bitcoins will ever be produced. ‘Crypto mining’ has already resulted in the creation of about 18 million bitcoins. Bitcoin mining is a significant industry where miners use powerful computers to execute transactions. These transactions are added to the blockchain ledger, which refers to the technology that powers cryptocurrencies, as “blocks” in the ledger.

This work requires a significant amount of computer power, which is expensive. This is the reason the “miners subsidy” or “block subsidy,” which is paid to the miner who processed a block when it is added to the blockchain, exists. On each block transaction, a predetermined number of new bitcoins are released, and this is also how new bitcoins are introduced to the supply chain. The miners can employ an exchange to sell their acquired bitcoins.

The 50% decrease in pay for Bitcoin network miners is referred to as the “halving.” What may happen to the price of bitcoin during this period is what has traders and investors most interested.

When Was The First Bitcoin Halving?

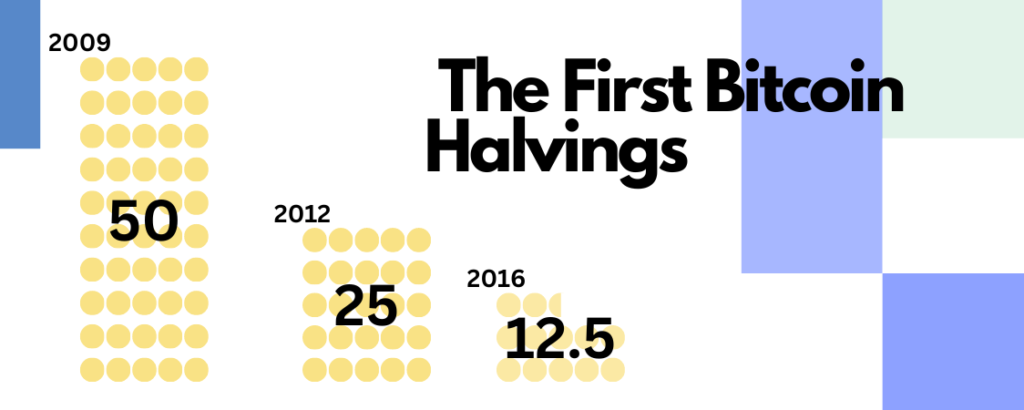

In November 2012, the first bitcoin price halving took place. While the one that followed happened in July 2016, the most recent halving was in May 2020,

When Bitcoin was introduced in 2009, the payout, or subsidy, for mining initially started at 50 Bitcoins every block. The amount is cut in half each time there is a new halving. For instance, the incentive for mining bitcoins decreased to 25 BTC for each block during the first halving.

In 2140, the final halving will take place. There will be 21 million Bitcoin in circulation at that time, and no new coins will be produced. From that point on, miners will only get transaction fees from users who conduct transactions on the blockchain.

To make up for lost Bitcoin revenue, Richard Baker, CEO of miner and blockchain services business TAAL Distributed Information Technologies, notes that miners may divert transaction processing capacity away from Bitcoin once the next halving occurs to find higher transaction fees elsewhere. Less mining activity would result in a less secure network, suggest experts.

However, Patricia Trompeter, CEO of cryptocurrency miner Sphere 3D Corp., points out that while the halving lowers the payout for miners, it does so without lowering the demand.

When Does Bitcoin Halving Happen?

Approximately every four years, or when 210,000 blocks have been mined, the halving occurs. The halving will take place at block 840,000 in April 2024. While blocks are typically added to the blockchain every ten minutes, it can be challenging to determine the exact date and time because slight inconsistencies can build up to significant differences.

The halving is predicted by several analysts to occur on April 26, though this date has the potential to change. The number of bitcoins awarded to miners per block will decrease by halving, from 6.25 to 3.125. The initial mining incentive for Bitcoin was 50 bitcoins. The price fell to 25 bitcoins on November 28, 2012, and again to 12.5 bitcoins on July 9, 2016.

However, the fact that fewer bitcoins will make their way into the supply chain and that demand will, on balance, remain roughly flat is what most traders, investors, and crypto fans are most enthusiastic about. This change in supply versus demand may contribute to an increase in the price of the coin.

Does Bitcoin Halving Affect Price?

Events that mark the halving of the Bitcoin supply are key turning points in the history of cryptocurrency and are widely watched by the community because of the potential effects they may have on supply dynamics and pricing.

The Bitcoin cycle significantly benefits from the halving of the Bitcoin supply. Halfing the block reward reduces availability, enhancing Bitcoin’s appeal as a deflationary asset. In the past, a decline in the rate of new Bitcoin issuance has been linked to greater interest and demand, which could lead to an increase in price. Additionally, it puts pressure on miners because their payouts are decreased, requiring efficient operations and possibly triggering industry consolidation.

Halving and Price Changes in The Past

Even while the consequences may not always be instantaneous, Bitcoin halving events historically have had a substantial impact on the price of the cryptocurrency. Understanding the pricing dynamics around the last three halving events offers useful insights.

Six to twelve months after a price-halving event, there will typically be a noticeable price increase.

Additionally, before a halving, investors frequently bid up the price of Bitcoin in anticipation of a subsequent price surge. The occurrence of a price increase cannot be assured, however, as the circumstances underlying each incident of halving are distinct.

Here are two ways Halving directly impacts the price of Bitcoin:

–Reduced Earnings: By halving the benefits miners receive for validating transactions, the network will expand more steadily and healthily. The halving assures that Bitcoin’s supply is limited and finite by slowing down the rate by which new coins are created, possibly supporting Bitcoin’s value over time.

–Reduced Inflation Rate: Following a halving event, the amount of new coins entering the market is cut in half, which lowers the inflation rate of Bitcoin. Because of the lower inflation, there may be more demand for Bitcoin, which could increase the price.

Market participants and analysts differ on the effect of Bitcoin’s price halving. Some predict that the halving will result in a considerable price increase because of the lower inflation rate, which will enhance demand and raise the value of the asset.

2012 Halving

On November 28, 2012, the first halving took place, reducing the Bitcoin block reward from 50 BTC to 25 BTC. Within a year, the price of 1 BTC rose from $12 to approximately $1,031.95, representing an increase of over 8,500%. By this time, 210,000 blocks were successfully mined, and half of the entire supply of bitcoins (10.5 million) had been made available for use.

2016 Halving

In the cryptocurrency community, the second halving, which was much anticipated, happened on July 9. When the 420,000th block had been mined, the block reward for Bitcoin had once more been halved, to 12.5 BTC. At that time, Bitcoin was trading for $650.96. After a brief decline, 526 days following the halving event, the price of a single bitcoin rose to a record-high level of $20,089.

2020 Halving

The latest halving took place on May 11 despite several unanticipated factors including the COVID-19 crisis’s effects, which contributed to the price collapse of bitcoin in March. At the 630,000th block, when Bitcoin was priced at about $8,787 per bitcoin, the block reward was halved, dropping from 12.5 to 6.25 BTC. A further 18 months passed before Bitcoin’s peak, which was roughly $69,000.

Will Bitcoin Price Rise After 2024 Halving?

As a result, there is a lot of anticipation surrounding the next Bitcoin halving event and how it will affect the price of BTC. It’s hard to predict exactly how it will impact Bitcoin pricing. The price of BTC increased after the Bitcoin reward was cut in half in each of the last three Bitcoin halving events. However, The crypto industry is still recovering from the historical destruction of 2022, so 2024 might behave differently. BTC is already having difficulty breaking the $30K support, contradicting experts’ inaccurate price expectations.

Even though many experts predict that the 2024 Bitcoin halving event will cause an upsurge and push the price of Bitcoin to a new record high. In the end, it depends on several variables, including macroeconomic conditions, regulatory developments, and market sentiment.

Conclusion | Bitcoin Halving Explained

The halving of Bitcoin highlights the cryptocurrency’s own economic architecture and supply dynamics and marks an important turning point in its history. The environment of digital currencies continues to change with each new event that takes place. Investors and enthusiasts can better grasp Bitcoin’s long-term potential and its role in transforming the world of finance and transactions by comprehending the technical complexities and economic effects of halving.