Despite being one of the key asset classes accessible to investors, many people are still unaware of the true nature of commodities. Since raw resources are essential to economies and businesses around the world, commodities have a different correlation with other markets than ordinary equities.

This article aims to clarify widespread misconceptions about commodity investing while examining the fundamental principles, dynamics, participants, and vehicles involved. The idea is to give readers the information they need to understand the special place that commodities have in well-balanced portfolios that help different market scenarios. We’ll outline the fundamentals of commodities investing throughout, as well as how integrating it properly distributes risks and may increase returns.

What Exactly are Commodities?

Basic items used as inputs in the global economy that are exchanged for a price on exchanges are referred to as commodities. The majority of goods can be classified as either soft or hard. Hard commodities are industrial materials that are used to fuel manufacturing, such as coal, natural gas, crude oil, and base metals. Soft commodities are agricultural goods that impact grocery budgets, such as corn, wheat, cotton, cattle, and cocoa. Despite having a different fundamental worth than fiat money or stocks, commodities nevertheless show price cycles that are impacted by monetary policy, weather patterns, social shifts, and production economies.

How do Supply and Demand Impact Commodity Prices?

Commodities, like normal microeconomic models, have volatile prices that are mostly driven by supply and demand dynamics. When output exceeds consumption, stockpiles increase, causing an excess supply that lowers prices until shortages force production to be reduced. In addition, increased economic demand stimulates increased consumption, which in turn absorbs surpluses and drives up prices when inventories run out and eventually reduces demand.

Speculators make investments that might potentially magnify such swings by reflecting macroeconomic expectations for consumption and growth in the global gross domestic product. Comprehending the specifics of supply and demand enables one to tactically coordinate investments amidst fluctuating market conditions and underlying principles.

Are There Different Types of Commodity Investors?

Commodity markets are open to anyone, but investors’ natural tendency is to concentrate on taking advantage of either short- or long-term price variations. Traders typically use futures contracts to communicate their tactical supply/demand perspectives, focusing on short-term holdings. Through forward agreements, producers and merchants long-term hedge their production and procurement costs. Large financial institutions, meanwhile, passively mimic benchmarks in the management of indexed-based commodity assets. Additionally, some use commodities as hedges against inflation in shaky economic times or use commodity ETFs. Whatever the reasons, a solid understanding of the fundamentals is still necessary for any successful investment.

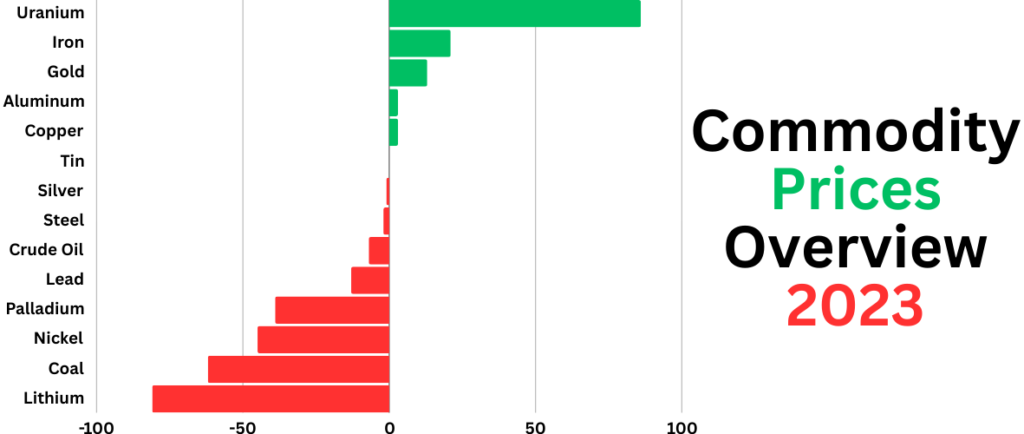

Which Factors Impact Commodity Prices?

Several interrelated forces significantly influence commodity valuation movements necessitating their blended consideration. Monetary policies impact interest rate-sensitive asset classes like commodities as tightening tends to aggravate inflation causing bearish sentiment. Weather anomalies disrupting harvests trigger price shocks rapidly ameliorated by altered production.

Economic health directly determines industrial/agricultural demand affecting supply-demand balances. Financialization correlates with speculator participation potentially destabilizing pricing. Geopolitical risks impact production/trade flows while dollar fluctuations alter valuations for overseas competitors. Comprehending such nuanced drivers through technical indicators and spot prices sustainably informs investment decisions.

Does Commodity Investing Represent A Risky Asset?

Some people are discouraged from including commodities into their investments because they associate commodity price volatility with risk. But experts also know that, when combined properly, commodities offer significant diversification advantages as a unique, uncorrelated asset class.

Commodity returns, as a dollar hedge, frequently show to be steadier or even grow during equity market declines. Additionally, commodities naturally outperform bonds during inflationary times, maintaining the stability of real buying power.

Because of their weak long-term association with conventional holdings, diversification rather than concentration lowers portfolio risk. Investing in commodities over the short term requires patience for short-term swings, but investing over longer periods of time smooths valuations during persistent trends.

How Can Commodity Investing Strengthen Returns?

The core of successful commodities investing is not so much seeking absolute high returns as it is catching cyclical price gyrations. Experienced players take calculated risks and use risk-management strategies to minimize short-term losses while playing long-term trends.

In order to identify inflection moments, this entails assessing elements such as production capacities, weather projections, economic indicators, speculative posture, and geopolitical tensions. Investing in these events at different times via a variety of vehicles may improve risk-adjusted returns compared to benchmarks. In the meanwhile, firms that depend on raw materials as inputs can stabilize their operational costs by hedging through commodity futures. When thoughtfully combined with traditional equities, their individual performances enhance portfolios.

Do Managed Futures Perform Well for Commodity Investing?

While often overlooked, managed futures represent a compelling vehicle for diversified commodity participation. They provide access to trend-following models developed by Commodity Trading Advisors systematically trading numerous global futures markets from currencies and interest rates to energies, grains, and metals. Offering returns exhibiting a low correlation with stocks and bonds, managed futures have historically generated positive returns during both rising and falling equity/fixed-income environments.

Their dynamic portfolio rebalancing across 160+ futures markets enhances risk management by spreading bets versus static benchmarks exposed to any one sector vulnerable to shocks. And regulative oversight ensures best operational practices maximizing investors’ odds capitalizing on sustainable pricing trends via professional guidance. For longer commitments amenable to interim volatility, managed futures afford competitive risk-adjusted returns through leading-edge quantitative approaches.

How Can Position Sizing Optimize Commodity Investing?

Deciding optimal position sizing remains crucial for mitigating commodity investing risks and magnifying opportunities amid fluctuations. Seasoned participants consider total portfolio size, allocated risk capital, volatility tolerances, and holding periods appropriately scaling entry quantities.

During trending periods with strong technical/fundamental confirmation, larger positions capture accelerating momentum while preserving downside protection through stops or trailing stops during consolidative sequences. By thoughtfully calibrating bet sizing according to prevailing conditions, traders participate fully in surrounding cyclical inflection points without excessively threatening overall risk profiles. Such careful differentiation serves sustainability over both appreciating and declining intervals within diverse macro backdrops.

Conclusion

Commodity investing is a significant asset class that, when done wisely, may provide balanced portfolios with major diversification characteristics and chances to increase returns.

Gaining knowledge of its inherent characteristics, such as macroeconomic sensitivity and supply/demand dynamics, enables participants to take advantage of commodities’ independent performances rather than focusing only on the short term. Expert commodity traders are successful because they carefully combine fundamental and technical analysis that impacts numerous interrelated variables at once. In the meantime, managed futures funds use tried-and-true quantitative methods to automate this procedure across international futures marketplaces.

Whatever the vehicle, understanding the risk management qualities of commodities and using cautious methods for positioning and sizing provide success in a range of economic environments.