Value investing is one of the most effective and time-tested strategies for achieving strong long-term returns in the stock market. Pioneered by legendary investors like Benjamin Graham and Warren Buffett, it focuses on identifying high-quality companies that are trading for less than their intrinsic worth. By conducting thorough fundamental analysis, value investors seek to take advantage of temporarily undervalued stocks poised to generate substantial gains as the broader market recognizes their true potential.

What is Value Investing?

At its core, value investing prioritizes identifying securities trading at a low price to what their businesses are intrinsically worth. It looks beyond random price fluctuations to focus on long-term business fundamentals and competitive advantages that are not fully reflected in the current share price. Value investors have confidence that over time, as a company’s operations and financial results improve, the market will recognize this hidden value and reward it with stock price appreciation. The strategy emphasizes thorough research, adequate margin of safety against potential downside, and patience to allow investments to reach their fair value.

What are the Principles of Value Investing

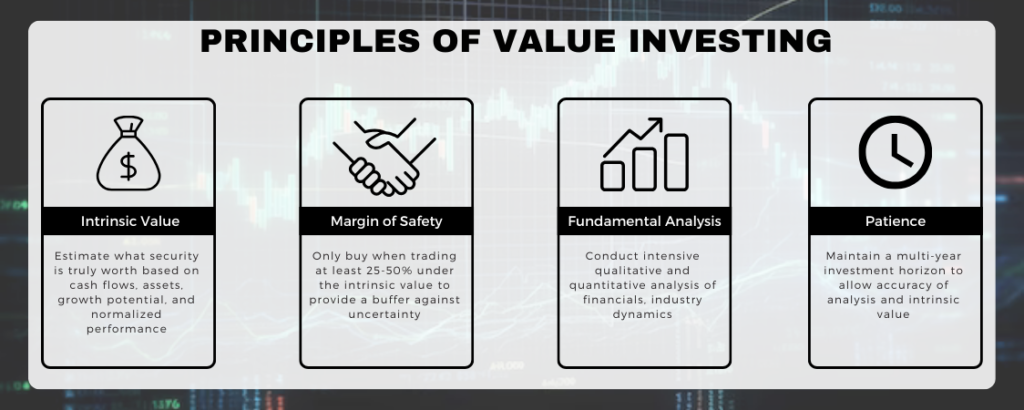

Several defining principles can help you when value investing:

– Focus on Intrinsic Value: Estimate what security is truly worth based on cash flows, assets, growth potential, and normalized performance over the long run.

– Margin of Safety: Only buy when trading at least 25-50% under the intrinsic value to provide a buffer against uncertainty or below-average performance.

– Fundamental Analysis: Conduct intensive qualitative and quantitative analysis of financials, industry dynamics, competitive advantages, management quality, and macroeconomic factors.

– Price is Irrelevant: Ignore random price fluctuations and instead focus on assessing the long-term business quality and realistic earnings power.

– Patience: Maintain a multi-year investment horizon to allow accuracy of analysis and intrinsic value to materialize in the public market.

Valuation Methodologies

There are several analytical approaches that value investors employ to estimate a company’s intrinsic value. The dividend discount model (DDM) involves forecasting a company’s future dividend payments and then discounting them back to the current dollar value using an appropriate discount rate. Another popular technique is the discounted cash flow (DCF) model, which projects a company’s unlevered free cash flows into the future and discounts them back using the weighted average cost of capital.

Comparable companies analysis also provides valuable valuation estimates. This involves comparing valuation multiples like the price-to-earnings ratio (P/E), price-to-book ratio (P/B), and price-to-sales ratio against similar companies in the same industry. Margin analysis examines trends in a company’s profit margins over time as well as its ability to earn returns above its cost of capital. Finally, the asset-based approach estimates the net asset value of a company by determining the worth of its tangible assets and then discounting the values of any non-core assets to derive an estimated breakup value.

By combining results from multiple techniques, value investors can develop a more strong estimate of a company’s intrinsic value that is supported by different analytical approaches. Ongoing monitoring is also important to ensure any changes to a company’s assumptions or those of its peers remain valid over time. Applying several methods provides a fuller picture versus relying on just one alone.

What are the Pros and Cons of Value Investing

Pros

– Downside Protection: The margin of safety focus aims to minimize losses from poorly selected or timed investments.

– Compounding Gains: Earnings power realization leads to strong long-term capital growth and avoiding overpaying creates significant returns.

– Simplicity: Fundamental value principles can be applied by any investor with research skills regardless of education or experience.

– Low Required Capital: A concentrated portfolio achieves excellent diversification effects from just 10-30 holdings.

– Stress-Resilient: Sound low P/E companies often outperform during recessions and market downturns.

– Tax Efficiency: Long-term appreciation is generally favorably taxed as capital gains versus shorter-term trading strategies.

Cons

– Value Traps: Situations where intrinsic value is underestimated, or growth never materializes as anticipated can lead to losses.

– Behavioral Biases: Temptations exist around chasing glamorous growth stories and panic-selling quality firms during corrections.

– Market Cycles: Periods where growth stocks outperform, or quantitative

Conclusion

When implemented exactly with discipline and patience, value investing has endured as one of the most successful evidence-based strategies for long-term wealth creation. By focusing on high-quality, lowly valued companies and tolerating short-term volatility, this contrarian approach aims to profit from permanent capital appreciation generated by strong underlying businesses purchased opportunistically by the market.

Proper due diligence, valuation methodologies, portfolio management, and risk mitigation techniques can unlock the potential reward value that has historically been delivered time and again. With appropriate temperament, it remains a highly useful framework providing durable advantages to passionate long-term investors.

Disclaimer

All investments and strategies involve risk of loss, and nothing featured on Finance Today guarantees positive results, profit or protection against losses. Finance Today does not endorse any companies, products, or services that may be referenced on this site. Readers should not make any financial decision or strategy based solely on the information provided here.