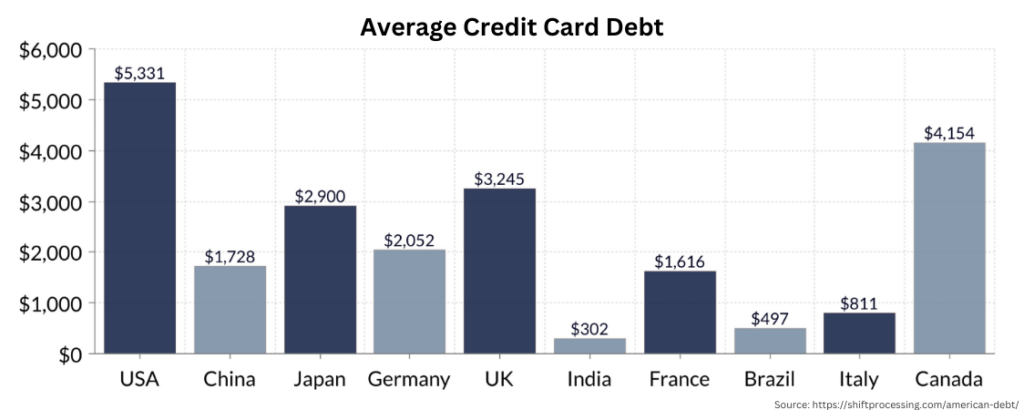

Debt has become a major issue facing many consumers in recent decades. Whether it’s large credit card balances, auto loans, mortgages, or student loans, it seems people are carrying more and more debt than ever before. Total household debt in America surpassed $14 trillion as of early 2020. This begs the question – why do people take on so much debt?

Changing Social Attitudes

One influence is a shift in social norms and expectations over time. Is it normal to have a lot of debt? Well in the past, there was no good debt and it was seen more as a taboo to be avoided. But in the late 20th century, societal views began to view debt more casually as a tool to obtain goods and services now rather than delaying gratification. Credit cards emerged as a widely accepted form of consumer financing tied to convenient revolving lines of credit.

This shift fostered the mindset that you don’t necessarily need to save up for big purchases – you can simply borrow money to get things now and pay it off over time. However, for some, this perspective makes it easy to take on more debt than is reasonably affordable. When everyone else seems to be using credit freely, it’s harder to resist.

Rising Cost of Living Pushing People into Debt

At the same time, social views were changing, and the cost of many staples increased rapidly. Housing, education, medical care, and other essentials became dramatically more expensive. This placed greater financial pressure on households. To reach traditional milestones like homeownership, obtaining a degree, funding retirement, or starting a family, many feel they have no choice but to assume debt loads that were uncommon in prior generations.

While income levels have grown over the decades, the pace of cost increases for many necessities has consistently outpaced wage growth. As basic budgets became stretched more thin, many felt forced to rely on credit to maintain their standard of living or achieve life goals.

Access to Credit Expands

Hand in hand with the rising cost of living came easier access to credit lines that enabled debt accumulation. The credit industry aggressively marketed credit cards, loans, and other products throughout the 80s and 90s. This helped fuel economic growth but also cultivated greater reliance on debt as a financing tool.

Where credit options were once limited primarily to mortgages and car loans, now almost anyone could qualify for numerous revolving credit accounts and a variety of personal loan types. High credit limits encouraged overspending, and confusing or misleading terms sometimes hid the true cost of interest payments long-term.

Changing Family Models

Shifting household demographics also influenced the debt equation. As more women entered the workforce, dual-income households became common. But higher living standards drove inflation. New expectations emerged for luxuries like vacations, dining out, and extracurricular activities for children.

At the same time, divorce rates rose substantially. Where assets were once pooled by multi-generational family structures, now single parents often shouldered more costs alone. Between higher costs of living and changes in family support systems, debt loads per household escalated drastically.

Overconfidence in Future Earnings

Survey data shows many deeply indebted consumers expressed overconfidence that future income gains could more easily pay down existing balances. However unplanned life events like job changes, health issues, or recessions are difficult to predict and can undermine projections.

With credit easily available, it’s psychologically easier to justify borrowing under assumptions that tomorrow will unfold as hoped, rather than planning financial resilience for unexpected storms. When earnings don’t materialize as envisioned or emergencies strike, debt spirals out of control. For some, debt loads may have been unrealistic given their actual income levels and risks.

Lack of Financial Literacy

Despite living in a highly complex financial world, many high school graduates lack even basic money management skills. Financial literacy standards are not uniformly strong. Without a full understanding of concepts like interest, budgeting, investing, or the true long-term costs of revolving debt, consumers are more vulnerable to marketing influences.

They may not fully comprehend the danger of minimum payments that barely cover accruing fees. Emotion-based spending habits develop without knowledge to control impulses. Generations with little savings culture passed down can fall victim to “buy now, pay later” schemes before realizing long-term implications. Improving education on personal finance principles could help curb debt dependence.

Conclusion | Why Do So Many People Get Into Debt?

In conclusion, rising household debt levels over the past decades stem from numerous interrelated causes. Changes in social attitudes made debt more normal while costs for necessities like education and housing increased dramatically. Simultaneously, easier access to various forms of consumer credit generated overspending. Evolving family structures and unrealistic confidence in career paths also contributed.

Most significantly, weaknesses in financial literacy education have left many ill-equipped to navigate increasingly complex financial options responsibly. Comprehensive solutions are needed – involving credit market reforms, efforts to reduce predatory behaviors, improved essentials affordability, and enhanced education to cultivate healthier personal money management skills from an early age.