Inflation has always been a problem for people when thinking about their long-term finances. Inflation has always devalued stored cash and made people wonder how should they save for the future. Some have said the solution is to use gold to beat inflation, however, is that the case? In this article, we will discuss if gold truly is the hedge on inflation.

Is Inflation a Threat to Your Purchasing Power?

Inflation is one of the biggest threats to the purchasing power of one’s savings over the long run. As prices rise due to too much money chasing too few goods, any cash sitting idle in a bank account loses value each year. Over decades of even modest inflation at 3%, the real worth of $10,000 saved declines by over 60%. This hidden tax makes it crucial for investors to find assets protecting wealth from rising consumer costs. While stocks have historically outpaced inflation, their risks make gold an appealing hedge worth considering for beating inflation.

Does Gold Historically Preserve Purchasing Power During High Inflation?

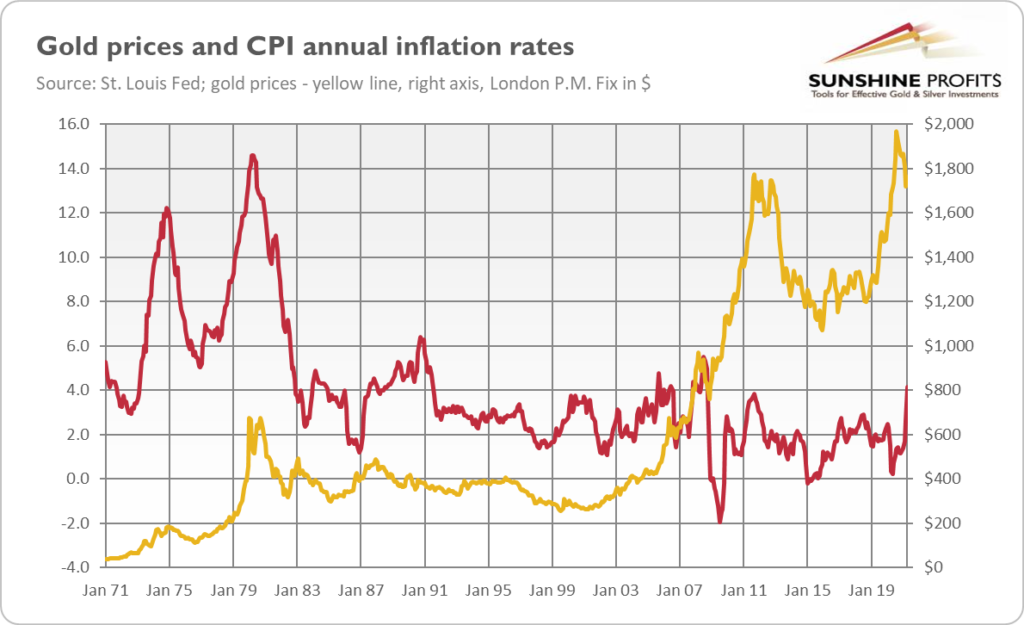

Studies of past inflationary eras demonstrate gold’s effectiveness at maintaining the real value of assets when prices surge. During the runaway U.S. inflation of the 1970s that saw rates hit 12%, gold increased in value by over 700% and outperformed both stocks and bonds. More recently in Venezuela and other countries experiencing hyperinflation, those owning gold preserved capital while local fiat currencies collapsed. This shows for investors seeking to safeguard savings from inflation, gold can serve as a stable store of value when prices escalate beyond normal levels.

Can Investors Rely on Gold To Beat Inflation in All Economies?

While gold performs admirably against high inflation, its ability to consistently outpace moderate consumer price increases over the long run is debated. From 1971 to 2021 when U.S. inflation averaged 3.8%, gold had a negative 0.4% annualized return according to macro intelligence firm Macro Hive. This illustrates gold may not be the ideal tool for outpacing all inflation environments. Its effectiveness depends on global dynamics like monetary policy, economic stability, and market expectations regarding real interest rates. For certain anti-inflation benefits, diversification across other assets provides more dependable inflation protection.

Should Precious Metal Stocks or Funds Be Considered as Well?

Individual gold bullion carries additional risks like storage costs and marketability issues. It also lacks income generation. To mitigate these factors, many investors opt for stocks of mining companies granting exposure to gold’s inflation-fighting qualities alongside stock-like returns. Leading producers like Barrick Gold and Newmont have historically gained in inflationary periods while providing dividends from profitable mining operations. Gold funds further diversify idiosyncratic company risks while imparting professional management of the physical metal. Precious metals equities can help inflation-minded investors achieve gold-backed participation in markets.

Can Other Commodities Also Guard Portfolios from Rising Prices?

While gold is renowned for maintaining purchasing power during currency crises, diversifying across a broader commodity basket offers arguably better protection against moderate inflation over the long haul. Important hard assets like energy, agriculture, livestock, and industrial metals underpin manufacturing and consumption, directly benefiting from increases in the overall price level. Funds tracking indexes spanning these sectors capture their inherent inflation-hedging properties while mitigating overdependence on one market like gold alone. Combined commodities approaches may more successfully allow investors to use real assets against inflation.

How Does an Investor Build the Right Gold or Commodity Allocation?

With no perfect tool for beating all inflation outcomes, strategic diversification according to an individual’s time horizon and risk tolerance can optimize inflation protection. For example, younger investors seeking long-term capital appreciation may overweight gold mining stocks alongside technology holdings. Those closer to retirement may raise safer commodities and gold bullion weightings within balanced, income-producing portfolios. The allocation should also account for already existing exposures. For instance, pension holders with inflation-indexed incomes require less hedging. A holistic financial plan incorporating inflation risks delivers the most comprehensive approach.

Are Momentum Signals Helpful for Timing Gold into Weaker Dollars?

While gold maintains value against inflation over decades, timing one’s entries more tactically can bolster returns. Strategists advocate monitoring monetary conditions, inflation expectations, real rates, and the USD’s global role to gauge when gold may appreciate faster. Shorter-term momentum indicators like moving average crossovers also help identify bullish phases to emphasize gold in portfolios aiming to beat inflation with the metal. For instance, inverting yield curves often precede dollar downturns during which inflation risks may surface – prime opportunities for enhancing gold positions. Technical analysis adds still more refined guidance on exploiting gold’s inflation-fighting qualities.

What Other Risks Come with Using Gold To Beat Inflation?

While gold holding provides excellent macro-level protection against sustained currency debasement, it also carries unique risks depending on one’s goals. Its non-income-generating nature goes against the needs of retirees relying on current portfolio income. It may also experience short-sighted but painful multi-year bear markets like from 2011-2015 when bets on inflation failed to materialize. Sudden rallies from macro headlines require discipline to avoid exacerbating drawdowns. Regulatory uncertainty surrounds gold investments in some nations as well. Diversification cushions these single-asset deficiencies, adding balance for optimally tackling inflation through gold’s historic preservation of value.

Conclusion

Gold’s robust track record of maintaining purchasing power during high inflationary periods renders it a reasonable strategic consideration within balanced portfolios. Its non-correlation to other assets reduces volatility when included alongside equities, housing, bonds, and commodities which together fare relatively better against overall inflation over the long term. While no single solution exists, a diversified, flexible approach judiciously incorporating gold and commodities tailored to an investor’s needs can strongly improve outcomes when rising prices eat away at wealth. Those willing to thoughtfully deploy gold to beat inflation stand to benefit significantly from the precious metal’s historically potent inflation-resistant qualities.