In every modern economy, governments set taxes on income, goods, services, property, and financial transactions to fund important public services and infrastructure. However, the complex tax codes employed incorporate many types of taxes with varied tax bases, rates, and collection methods. This article examines the main categories of taxes imposed worldwide to raise an understanding of fiscal systems and taxpayer obligations. By learning about the various types of taxes, readers will gain valuable insight into how governments finance operations and how tax burdens impact businesses and individuals.

What are Some Major Direct Taxes?

One of the most well-known types of taxes is the income tax, which is applied directly to an individual’s earnings or a business’s profits within a certain period. For individuals, progressive income tax rates typically mean higher earners face a higher percentage of tax on their overall income. Corporate income taxes also apply statutory rates to the taxable incomes of companies. Capital gains taxes are another direct tax imposing levies on the profits from selling assets like stocks or property that have increased in value. Direct taxes are usually collected from taxpayers by a revenue authority through regular estimated payments and annual returns.

What are Some Major Indirect Taxes?

Indirect taxes differ in that they are embedded in the price of goods and services rather than directly paid by the consumer. Value-added tax (VAT) has become one of the most important types of taxes globally, charged at each stage of production and consumption at a standard percentage rate. Sales taxes exist in some nations as an alternative consumption-based levy added at the point of purchase. Excise duties represent indirect taxes set on specific commodities like fuel, tobacco, and alcohol. Import tariffs and duties could also be considered indirect taxes on international trade flows. Overall, indirect taxes are often more regressive since low-income groups spend a greater portion of wages on consumption.

What are Some Other Significant Tax Categories?

Payroll or wage taxes constitute a major type collected from both employers and employees to fund social programs like Social Security, Medicare, and national pension plans. Property taxes, assessed by local councils, apply rates to the value of owned real estate and land to contribute to neighborhood services. Wealth taxes have also emerged, targeting individual net worth over a certain threshold through annual asset assessments or inheritance/estate levies. Environmental or ‘green’ taxes pursue economic incentives to conserve resources through levies correlated to pollution. Financial or capital transaction taxes serve several purposes, taxing exchanges like the issuing of securities or currency conversions.

How are Different Types of Taxes Collected?

The mechanisms for tax collection vary according to the types of taxes. Individual income tax is typically paid as pre-payments during the tax year based on projected liability, with annual filing reconciling the final amounts. Corporate taxes usually involve estimated installment payments and year-end reporting. VAT and sales taxes get remitted by merchants periodically. Payroll taxes are automatically deducted from salaries. Property taxes issue bills for payment. Wealth and inheritance taxes evaluate holdings upon death or sale. Some transaction taxes like stamp duties collect in real time. Overall, modern digital payment systems aid compliance through audits and penalties that enforce complete reporting of various types of taxes.

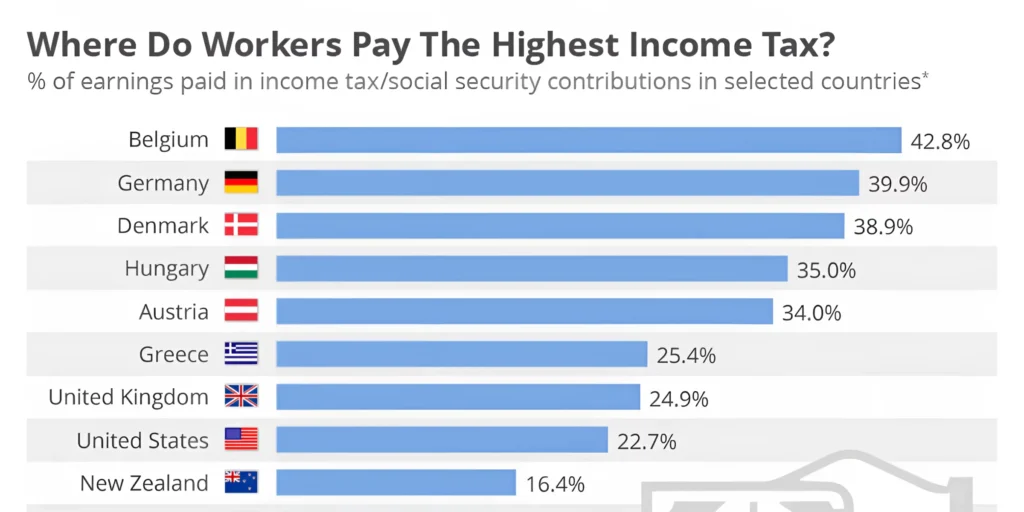

How do Tax Rates Differ Between Tax Types?

Rate structuring shows diversity between tax types as well. Income tax schedules apply marginal rates incrementally to tax brackets. Corporate tax rates operate as flat percentages of profits. Indirect taxes like VAT and sales levies stick to single-digit standard rates. Payroll tax splits fix rates for both employee and employer portions. Property taxes customize millage rates set by local assessors. Wealth and inheritance taxes scale up significantly at higher wealth/gift thresholds. Environmental taxes correlate amounts directly to externalized social/environmental impacts. Considering varied purposes and tax bases, heterogeneity in rate design across the types of taxes promotes balanced government revenue generation.

How do Different Types of Taxes Affect Economies?

Naturally, the choices of tax types and their specific calibrations have diverse macroeconomic impacts. High-income tax rates could deter productivity and investments but fund public services supporting growth. Corporate taxes that are too burdensome may curb risk-taking but also finance infrastructure spurring business activity. Broad-based consumption taxes collect revenue efficiently without distorting production decisions as much as some other types of taxes. Well-designed Pigouvian environmental taxes address externalities without hurting output. Overall, the ideal balance of types of taxes considers distributional fairness alongside encouraging long-term economic dynamism through incentives.

What are Some Arguments For and Against Tax Types?

Reasonable debates exist regarding the appropriate scope and design of tax types. Advocates argue income taxes ensure contributions based on the ability to pay while corporate taxes curb immoral accumulation. However, high rates risk stifling entrepreneurship and work effort according to opponents. Supporters maintain indirect taxes collect efficiently from consumption but critics argue they disproportionately affect low incomes. Environmental tax proponents cite sustainability benefits while doubters question impact assessments. Wealth tax enthusiasts point to the lucrative base but detractors raise concerns over capital flight at very high levies. Overall, weighing policy trade-offs guides pragmatic reforms of tax structures involving varied types of taxes.

Are There Other Less Common Tax Types?

Beyond major tax categories, some less prevalent forms exist to address narrowly targeted policy aims. Sin taxes single out luxury or vice goods, usually tobacco and alcohol, to offset health impacts. Sumptuary or luxury taxes aim for lavish expenses like yachts or designer goods. Carbon taxes directly tax carbon dioxide emissions in line with the ‘polluter pays’ principle. Crypto-currency transaction taxes attempt to govern novel digital exchange mediums. Land-value and site-value taxes offer hypothetical non-distortive property taxation alternatives. Ephemeral taxes evaluate short-term capital gain holding periods more punitively than traditional capital gain tax treatment. Overall, innovative less common types of taxes indicate room for experimentation in addressing social challenges.

Conclusion | Types Of Taxes

When creating tax structures that combine different tax kinds, modern financial systems have a wide range of alternatives at their disposal. Different rate structures seek to strike a compromise between redistribution priorities, practicality, and efficiency, while direct and indirect taxes fulfill complementary roles in public finance.

Though imperfect and open to criticism regarding details, taxation remains the primary mechanism sustaining government functions powering civilized societies. By understanding the design, impacts, and debates around core and niche tax types, citizens can participate knowledgeably in shaping policies commensurate with democratic principles of representation and consent.