Many of the complicated acronyms used in the finance industry can be confusing to non-specialists. The abbreviation CLO, or collateralized loan obligation, is one example of this. Yet “what are CLOs?” CLOs are essentially a kind of structured debt security that is supported by a collection of bank loans. CLOs give investors the same exposure to bank loans in different risk and return tranches as other securitized securities. The technical aspects of CLOs and their operation will be covered in detail in this article.

What Are The Underlying Assets In A CLO?

The majority of the underlying assets in a CLO are bank loans to corporations. Banks give these leveraged loans, which typically have adjustable rates, to businesses with poor credit ratings. This implies that the interest rates on the loans fluctuate regularly to mirror changes in benchmark rates, such as LIBOR. CLOs are exposed to the larger, healthier segment of the corporate debt market when they use bank loans as collateral. CLOs may also own minor holdings in revolving credit facilities, high-yield bonds, and other fixed-income securities in addition to loans.

How Is A CLO Structured?

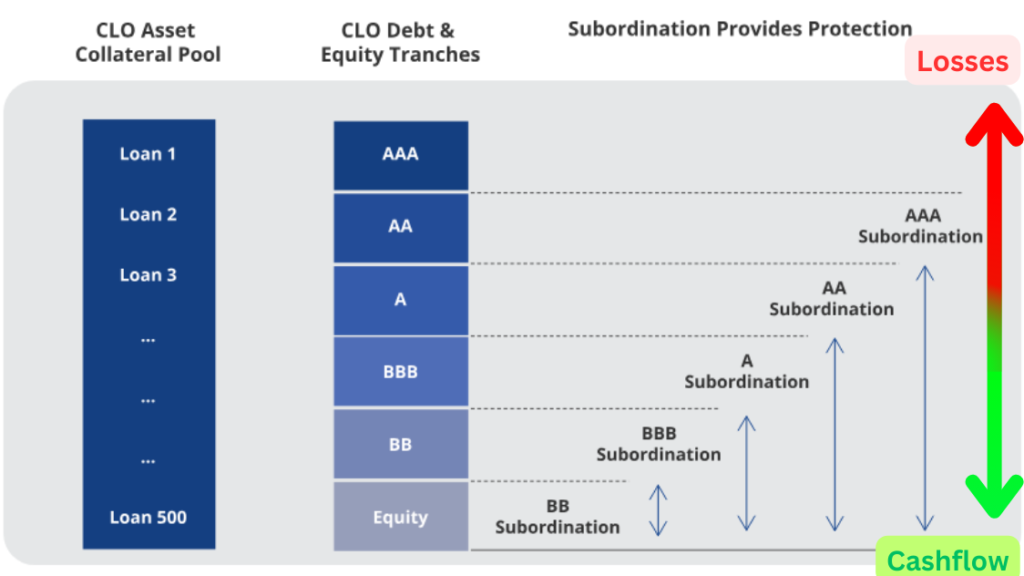

CLOs have a complicated structure with various tranches or risk categories. A special purpose vehicle (SPV) that issues several tranches of debt securities receives the collateral pool. Higher credit ratings are granted to senior tranches, who also have the first claim over cash flows from the collateral. They are thought to be the most secure areas. The last in the payment sequence, junior or equity tranches take the brunt of losses on collateral that defaults. The lowest-ranked and riskiest capital component is provided by equity investors to start the venture.

What Risks Do Investors Face in Different Tranches?

A CLO’s senior tranches have extremely little chance of losing money because of their senior position in the capital structure. Credit rating firms provide them AAA through A credit ratings. Mezzanine tranches typically have ratings of BBB to BB and involve a moderate risk of loss. Since they take on collateral losses first, the junior and equity tranches are the ones with the highest level of risk. Through effective risk stratification during the tranching process, CLOs can cater to a range of investor types and risk tolerances by providing distinct risk-adjusted return profiles.

How Are CLOs Managed Over Time?

CLOs are debt structures that are actively managed. Inside preset parameters, a collateral manager is in charge of purchasing and disposing of assets inside the collateral pool. This makes it possible to gradually maximize returns by getting rid of underperforming assets and reinvesting cash flows in specific ways. The distribution of interest and principal to the various debt and equity tranches during the approximately five-year reinvestment term and beyond of the CLO is contingent upon asset selection, restricted discretionary sales, and reinvestment decisions.

What Are The Benefits Of CLOs For Investors?

CLOs offer an appealing alternative for fixed-income investors who are looking to gain exposure to leveraged corporate loans. Because they assume more default risk than investment-grade corporate bonds, they offer a greater yield. Depending on an investor’s risk tolerance, structuring into tranches enables access to safer senior debt or riskier junior debt. CLOs offer diversification over a wide range of underlying assets when compared to directly purchasing corporate bonds or loans. Additionally, rated actively managed CLO debt makes it accessible to a larger pool of investors.

Conclusion | What are CLOs

To put it briefly, when asking “what are CLOs” they are a specific kind of structured credit instrument that is supported by a wide range of corporate bank loans. CLOs make it possible to obtain the higher yields offered by leveraged loans through instruments designed to suit different risk appetites by issuing several tranches of debt securities. The goal of ongoing collateral management is to maximize returns gradually. CLOs can provide advantages of risk layering and diversification not found directly in that market. This is appealing for fixed-income investors looking for exposure to the floating rate loan asset class or extra yield. Understanding this widely used tool is crucial for informed involvement in the credit markets.

Disclaimer

Finance Today strives to provide our readers with factual, informative articles and resources on finance, investing and business. However, the contents featured on this website, including any articles, market commentary, tracks, trades, or other information, should not be considered personalized investment advice.